MicroStrategy: The Bitcoin Play Amidst Software Offerings

MicroStrategy (NASDAQ: MSTR) is often perceived not just as an enterprise software provider specializing in data analytics and business intelligence, but as a pivotal player in the Bitcoin landscape. This perception arises largely from its significant investment in Bitcoin, spearheaded by co-founder and Chairman Michael Saylor.

In 2020, under Saylor’s leadership (he was CEO at the time), MicroStrategy made headlines when it converted a substantial portion of its cash reserves into Bitcoin. This pivotal move not only positioned the company as a cryptocurrency titan but also marked it as a mainstream choice for those looking to invest in Bitcoin indirectly. Since then, MicroStrategy has not only sold stock but also taken on additional debt to further bolster its Bitcoin holdings. Remarkably, the company continues to channel free cash flow from its core software business into additional Bitcoin purchases, showcasing a unique strategy that merges traditional enterprise offerings with the burgeoning world of cryptocurrency.

As it stands, MicroStrategy boasts approximately 423,650 Bitcoin on its balance sheet, acquired at an average price of $60,324 per coin. This translates to a significant investment exceeding $25.6 billion, now valued at around $42.4 billion. The Bitcoin portfolio constitutes nearly half of MicroStrategy’s current market capitalization of $90.4 billion, emphasizing the weight of this cryptocurrency on the company’s overall valuation.

A Closer Look at Shareholder Impact

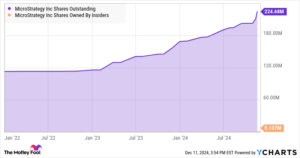

For investors, the path MicroStrategy has taken is essential to understand. While Bitcoin’s meteoric rise has garnered considerable interest, it’s crucial to scrutinize the financial maneuvers that accompany these investment strategies. Over the past two years, MicroStrategy’s share count has nearly doubled, a strategy that many consider highly dilutive. This dilution directly correlates with the company’s aggressive Bitcoin-buying tactics.

The implications for shareholders are stark. During this period, while the market cap of MicroStrategy skyrocketed by an astonishing 1,410%, the share price increased by just 657%. Although any positive movement in stock price is generally well-received, investors should tread cautiously. MicroStrategy plans to borrow around $21 billion from shareholders over the next three years, aiming to finance ongoing Bitcoin acquisitions while simultaneously incurring a similar amount in debt.

Why Tracking Share Count Matters

Before adding MicroStrategy to your portfolio, it’s vital to maintain a keen eye on its share count. The appetite for Bitcoin may create the facade of wealth generation in the long run, but the underlying strategies could significantly undermine shareholder value.

The Call to Action: Diversifying Your Portfolio

For those contemplating the risks and rewards of investing in MicroStrategy, consider this: the investment landscape is vast. The Motley Fool Stock Advisor recently highlighted ten superior stocks poised for remarkable returns, and surprisingly, MicroStrategy was not among them.

To put this into perspective, one of the stocks on their list, Nvidia, was recommended back in April 2005. If you had invested $1,000 at that time, your investment would have exploded to an astonishing $853,765 today!

Stock Advisor offers insights that can empower investors to make informed decisions, complete with a strategic portfolio-building framework and regular analyst updates. Their service has outperformed the S&P 500 substantially since its inception, more than quadrupling returns—proof that knowledge, timing, and strategy lead to success.

In summary, while MicroStrategy’s journey intertwines significantly with Bitcoin, investors must weigh the potential returns against the darker clouds of shareholder dilution and debt financing. Explore diverse avenues in your investment strategy, considering options that demonstrate a track record of success and sustainable growth.