Missing Out on Critical Financial Insights? Tune in to Our Daily Breakfast News!

If you’re interested in no-nonsense, insightful financial content delivered straight to your inbox, the Breakfast News newsletter by Extreme Investor Network is your go-to resource. Packed with essential updates to keep you informed and educated, it’s quick, insightful, and completely free! Sign Up For Free!

In January 2023, I shared a handpicked list of my top 10 stock picks for the year. Fast forward to today, and I’m pleased to report that those selections yielded impressive results. Investing $1,000 in each of those stocks would have netted you a whopping $13,301 by the end of the year, inclusive of dividends. In contrast, a similar investment in an S&P 500 index fund would have returned only $11,900. This means my stock picks outperformed market averages by an impressive 74%. At Extreme Investor Network, we pride ourselves on delivering actionable insights that lead to substantial returns.

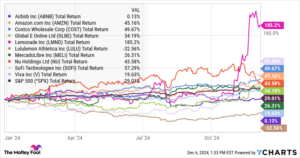

As 2023 closed, I revisited and updated my top 10 stocks for 2024, and I’m excited to reveal that they continue to outperform the market! An equal investment of $10,000 in these 10 stocks at the year’s start would have grown to $14,281 as of December 5, compared to the S&P 500’s $12,890—an impressive 48% difference.

These results are particularly encouraging amid a strong market year. During downturns, outperforming the index can be easier; for example, in 2022, a year where the S&P 500 dropped 18%, 51% of U.S. equity managers could not keep pace with the index. In stark contrast, during early 2024, 57% of large-cap U.S. equity managers lagged behind the S&P 500, which had rebounded with a 24% gain.

Now, let’s delve into the performance of my top 10 stocks for 2024:

-

Airbnb (NASDAQ: ABNB): After a stellar 59% increase in 2023, Airbnb has stabilized in 2024. While growth might be slowing, profitability has surged, and the stock is becoming more attractive to value investors, trading at only 22 times its trailing-12-month free cash flow.

-

Amazon (NASDAQ: AMZN): Amazon continues to lead the global cloud computing industry with its robust Amazon Web Services (AWS). The integration of powerful AI capabilities has been a game-changer, attracting new clients and solidifying its status as the largest U.S. e-commerce provider.

-

Costco Wholesale (NASDAQ: COST): Consistently recognized as one of the most reliable stocks, Costco has hit new all-time highs this year. If you’re in for the long haul, consider dollar-cost averaging as a strategy to accumulate shares in this retail giant.

-

Global-e Online (NASDAQ: GLBE): While still a relatively small player, Global-e has positioned itself well in e-commerce. Its cross-border solutions have attracted marquee clients like Disney and LVMH. With accelerating growth and a path toward profitability, this stock is set to continue its upward trend into 2025.

-

Lemonade (NYSE: LMND): Despite entering 2024 down more than 90% from its all-time high, Lemonade made significant strides toward profitability. Its innovative AI algorithms provide a unique edge in the insurance sector, showcasing its potential for explosive growth moving forward.

-

Lululemon Athletica (NASDAQ: LULU): While facing challenges with product launches in a competitive market for premium apparel, Lululemon still trades at a discount relative to the S&P 500 average. This could present a strategic buying opportunity for long-term investors.

-

MercadoLibre (NASDAQ: MELI): This e-commerce giant faced headwinds recently but remains a powerhouse with substantial profitability and growth potential across Latin America. Its market position continues to grow, driven by a dedicated customer base.

-

Nu Holdings (NYSE: NU): As a rapidly growing all-digital bank in Brazil, Nu boasts an impressive 110 million customers. Its effective cross-selling strategy enhances customer engagement and drives profitability as it enters new markets.

-

SoFi Technologies (NASDAQ: SOFI): SoFi’s transitions into a comprehensive financial services platform have shown results with four consecutive quarters of positive net income. Its expanding service offerings signal strong growth prospects ahead.

- Visa (NYSE: V): A stalwart in the financial sector, Visa continues to be a reliable growth stock. While slightly underperforming this year due to tech-driven market gains, its long-term track record makes it a dependable choice for investors.

While these stocks primarily represent growth opportunities, it’s essential to maintain diversification in your portfolio. A well-rounded investment strategy could include adding complementary stocks or an exchange-traded fund (ETF) to mitigate risk across various market conditions.

Investing has its ebbs and flows; it’s common for some stocks to underperform while others thrive. However, the key to wealth-building in the stock market lies in focusing on quality investments and adopting a long-term outlook.

Before you dive into an S&P 500 index fund, consider an alternative perspective: the Motley Fool Stock Advisor recently identified the 10 best stocks for investors, and interestingly, the S&P 500 didn’t make the cut. With picks boasting the potential for monster returns in the coming years, this could be the right time to reconsider your investing strategy.

Remember, investing intelligently requires time and research. Explore options that might best align with your financial goals—taking guidance from trusted experts can give you the edge needed to navigate the complex world of finance successfully.

Stay connected with Extreme Investor Network for crucial market updates, expert analysis, and tailored investment strategies that empower your financial decisions!