Unpacking Nvidia’s Recent Performance and Spotlighting a Less Expensive AI Alternative

As we dive into the world of artificial intelligence and semiconductor stocks, it’s impossible to ignore the remarkable rise of Nvidia (NASDAQ: NVDA). In 2024, shares of this semiconductor titan have skyrocketed 183%. However, beneath the impressive numbers lies a growing skepticism regarding Nvidia’s sustainable growth in the long run, spurring investors to look for alternatives.

Nvidia’s Impressive Yet Doubtful Gains

Despite an incredible rally, Nvidia’s stock has taken a step back, even after posting numbers that exceeded expectations. For the third quarter of fiscal 2025, Nvidia reported a staggering 94% revenue growth, pulling in $35.1 billion. Additionally, its year-over-year earnings surged by an impressive 103% to reach $0.81 per share. Yet the optimism was short-lived.

Investors are now questioning Nvidia’s revenue guidance of $37.5 billion for the current quarter, suggesting a slower growth rate of around 70% compared to the previous year. The anticipated rollout of Blackwell processors is placing additional pressure on profit margins, contributing to a decline in investor confidence.

Discovering Marvell Technology as a Compelling Alternative

For those who missed the Nvidia rush or are concerned about its high valuation—trading at roughly 31 times sales—Marvell Technology (NASDAQ: MRVL) may be a fascinating alternative worth considering.

When Marvell reported its fiscal 2025 third-quarter results last month, the chipmaker delivered solid figures with total revenue increasing by 7% year-over-year to reach $1.52 billion. This surpassed analyst expectations of $1.46 billion, and its adjusted earnings improved to $0.43 per share, beating the consensus estimate of $0.41.

The Data Center Business: A Growth Powerhouse

While Marvell might seem less flashy than Nvidia at first glance, a closer examination reveals its data center segment has become an immense growth driver. This sector now accounts for a hefty 73% of Marvell’s revenue, up from just 39% a year ago, and experienced nearly a double in revenue to $1.1 billion.

This strength in data centers is largely driven by the rising demand for custom AI processors and optical networking equipment. One of the most promising aspects is Marvell’s guidance for its fiscal fourth quarter, projecting revenue of $1.8 billion—a 26% jump from the previous year—far exceeding analyst expectations of $1.65 billion.

Unleashing Potential in AI Chip Sales

Marvell’s focus on AI technology is not just a fleeting trend. CEO Matt Murphy noted significant demand for its custom AI chips has been pivotal for its robust performance and forward guidance. The company is anticipating to "significantly exceed" its AI revenue target of $1.5 billion for the full year, with projections reaching as high as $3 billion next fiscal year.

As cloud providers innovate their in-house AI chips, Marvell, alongside Broadcom, stands to benefit significantly. The market for custom AI chips could balloon to a remarkable $45 billion by 2028, with an additional $26 billion revenue opportunity in data center switching and interconnect.

Future Growth and Valuation Outlook for Marvell

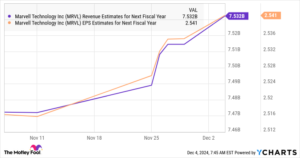

Marvell’s current financial guidance suggests that by the end of fiscal 2025, the company might land a total revenue corpus of $5.75 billion, reflecting just a 4% increase year-over-year. However, the upcoming fiscal year (starting in February) boasts predictions of a 31% rise in top-line growth paired with an impressive 63% increase in earnings.

Should Marvell maintain this momentum, with analyst projections hinting at sales reaching $7.5 billion, a trading multiple of 16 could elevate its market capitalization to $120 billion, marking a 43% increase over current valuations.

Don’t Miss Out: Seize Opportunities in the AI Investment Space

If you’re feeling like you’ve missed the boat on successful tech investments, now might be your moment. Our expert team at Extreme Investor Network is currently evaluating several “Double Down” stock recommendations that are poised for potential growth. It’s the perfect time to dive deeper and consider your options wisely.

- Nvidia: $1,000 invested at our recommendation in 2009 would yield $376,143!

- Apple: A $1,000 investment in 2008 would be worth $46,028!

- Netflix: Invest $1,000 back in 2004, and you’d have an astonishing $494,999!

We’re confident in our current insights into three remarkable companies that could shape the next investment wave in AI.

Take Action Now

With the right approach and timely information, you have the potential to capitalize on the promising AI landscape. Join Extreme Investor Network today and empower your investment journey with details that elaborate on opportunities you won’t find anywhere else.

(Note: Statistics and returns reflect analyses as of December 2, 2024, and are subject to market conditions.)

Disclaimer: Harsh Chauhan has no position in the stocks mentioned. Please consult with a financial advisor for personal investment advice.