The Ever-Evolving Relationship Between MicroStrategy, Convertible Notes, and Bitcoin

Michael Saylor, the co-founder and CEO of MicroStrategy Inc., continues to capture the spotlight in the cryptocurrency arena with his ambitious strategy to accumulate Bitcoin and leverage the unique financial instruments that propel his company’s growth. This blog post explores how Saylor has managed to harness retail and hedge fund excitement over MicroStrategy’s impressive stock rally, while also diving into the increasingly popular convertible arbitrage strategies that surround the company’s operations.

The Bitcoin Purchase Frenzy

In 2023 alone, MicroStrategy’s stock has soared over 500%, thereby attracting a vast pool of retail investors eager to ride the wave of cryptocurrency enthusiasm. Simultaneously, hedge funds—who often take a more detached view of market prices—are among the key players purchasing MicroStrategy’s convertible notes. For them, MicroStrategy’s strategy represents not just a bet on Bitcoin, but a calculated wagering on the company’s operational tactics.

Understanding Convertible Notes

Convertible notes play a pivotal role in funding MicroStrategy’s rapid Bitcoin accumulation. With over $6 billion raised from the sale of these financial instruments this year, the firm has been able to amplify its Bitcoin hoard to an astounding market valuation of around $40 billion. These low-interest, long-term securities offer investors the option to convert their debt into equity, potentially steering profits if the stock price surges. Saliently, it’s this blend of venture capital and cryptocurrency that draws substantial interest from savvy investors looking for arbitrage opportunities in highly volatile markets.

The Mechanics of Convertible Arbitrage

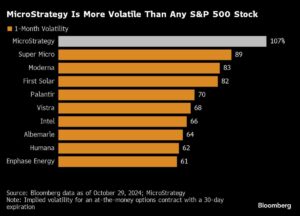

Eli Pars, co-Chief Investment Officer at Calamos Advisors LLC, has been a proponent of convertible arbitrage strategies, positioning MicroStrategy at the heart of these trades. The fundamental premise involves hedging to isolate the exchange feature of these convertible notes, portraying them as equity options driven largely by stock volatility. What makes this maneuver so appealing? MicroStrategy has exhibited a jaw-dropping average daily price movement of about 5.2% this year, dwarfing the 0.6% average for the S&P 500 Index.

High Volatility: A Double-Edged Sword

Saylor’s bullish forecast has capitalized on Bitcoin’s recent volatility. His challenge, however, rests in managing the uncertain waters of cryptocurrency fluctuations. The need for vigilance remains essential, as potential corrections in Bitcoin prices could send ripples through MicroStrategy’s financial health, creating substantial risks for convertible noteholders. Analysts, including David Clott of Wellesley Asset Management, note that if Bitcoin’s value retracts significantly, it could pressure the firm’s credit standing.

The Musical Chairs Dilemma

The current trend has sparked what some are humorously dubbing Saylor’s "perpetual-motion money machine." By consistently raising capital to purchase Bitcoin, MicroStrategy lifts its stock value, attracting even more investment. However, this dynamic creates a precarious situation akin to a game of musical chairs. What happens if the music stops? As the price-agnostic speculative investors flood in, there exists an underlying risk that the operation could collapse, potentially leaving many investors exposed.

A Unique Investment Landscape

Despite the risks, MicroStrategy’s recent bond offerings have attracted a mix of players eager for innovative opportunities. The convertible bonds are offered at comparatively accessible rates, providing considerable arbitrage potential for institutional investors. Saylor encapsulates the intent by stating, “Our job is to bridge the traditional capital markets… and we use Bitcoin to do that.”

Conclusion: The Gamble or A Calculated Bet?

The landscape surrounding MicroStrategy’s financial maneuvers presents a complex tapestry of innovation and risk. With high beta and volatility characterizing their stock and Bitcoin holdings, the allure of convertible arbitrage is potent. However, readers should remain cognizant of the looming risks associated with heavy exposure to Bitcoin—especially as the market dynamics evolve and potential corrections loom on the horizon.

At Extreme Investor Network, we continue to analyze the evolving strategies within the cryptocurrency ecosystem and the implications they hold for both retail and institutional investors. The intersection of traditional finance and digital currencies may just reshape the investment landscape in unprecedented ways—stay tuned!