Rocket Lab’s Meteoric Rise: What Investors Need to Know About This SpaceX Competitor

Rocket Lab (NASDAQ: RKLB) has taken the financial world by storm, boasting an astonishing 500% increase in its stock value over the past year. This surge far surpasses even the impressive gains seen in Nvidia during the same timeframe, capturing the attention of investors eager for high-growth opportunities in an ever-evolving sector. But what is behind Rocket Lab’s success, and why should you consider its future potential?

Firstly, Rocket Lab has positioned itself as a formidable competitor to SpaceX, which has long dominated the commercial space launch industry. Until recently, SpaceX was basically the only Western company capable of offering reliable orbital launches. Enter Rocket Lab, which has focused on smaller payload launches with its Electron rocket. This strategic move not only allows Rocket Lab to capture a specific market niche but also offers flexibility for clients needing to deploy smaller and experimental payloads.

A Launch Cadence That Keeps Investors Excited

Just this past week, Rocket Lab executed an impressive feat by successfully launching two missions within 24 hours — a clear indication of its robust operational capability and the demand for its services. The increasing global need for satellite deployments is evident, with Rocket Lab currently holding a backlog of contracts valued at over $1 billion. The company’s ability to scale operations will likely lead to increased revenue, and if the trend continues, profits could soar.

Since going public in 2021, Rocket Lab has reported revenue growth of 551%, positioning it as one of the fastest-growing companies globally. The real question remains: Can they maintain this momentum? Investors seem to believe that with enhanced launch frequency, the company is well-positioned for sustained success.

Broader Ambitions and Future Outlook

Rocket Lab doesn’t just stop at launches; the company has ambitious plans to integrate vertically by expanding into satellite payload production and even building electric solar arrays and space systems. This strategic diversification means that Rocket Lab not only launches satellites but also plays a significant role in their creation, leading to amplified revenue streams. With the space systems division now representing a substantial portion of its overall revenue, Rocket Lab is successfully evolving beyond its initial offerings.

But here’s where the flywheel effect comes into play: By providing end-to-end services, Rocket Lab makes it easier to upsell clients on additional services, further enhancing its revenue potential. Government backing, evidenced by a recent $24 million agreement related to semiconductor development for space systems, also bolsters investor confidence.

Key Developments to Watch

As Rocket Lab continues its expansion, two critical developments are on the horizon:

-

The Neutron Rocket: Scheduled for a debut in 2025, this larger rocket will allow Rocket Lab to carry heavier payloads and compete directly with SpaceX’s Falcon 9.

- A Dedicated Satellite Constellation: Plans to develop its satellite network for software and service distribution from orbit could significantly enhance profitability.

The potential growth is substantial; projections estimate revenues could soar to $5 billion in 10 years if current trends hold — suggesting the company could achieve net income margins of approximately 10%.

Valuation Concerns

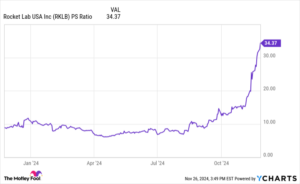

Despite the allure of Rocket Lab, the company’s current valuation raises red flags. With a market cap nearing $12 billion and a price-to-sales (P/S) ratio of 34 — significantly above market averages — there is a real concern about overvaluation. For instance, if Rocket Lab’s ambitious growth comes to fruition, it could still result in a price-to-earnings (P/E) ratio of 25 based on future earnings, which approaches the S&P 500 average.

Thus, while Rocket Lab has proven its potential and is indeed a company to watch, prudent investors may want to exercise caution before jumping in at current stock prices.

Consider Where Your Money Goes

As the adage goes, don’t fear missing out on opportunities; instead, focus on making informed and strategic investment choices. Investing in high-growth companies like Rocket Lab can be exhilarating, but it is essential to evaluate the risks carefully.

If you’re searching for the next big investment opportunity without the present risks associated with Rocket Lab, consider signing up for our "Double Down" alerts at Extreme Investor Network. Our team of analysts has a track record of identifying emerging stocks with groundbreaking potential.

For those interested, here are just a few stocks where early investors have seen incredible returns:

- Nvidia: A $1,000 investment in 2009 would now hold $358,460.

- Apple: If you’d invested $1,000 in 2008, you’d have $44,946 today.

- Netflix: A $1,000 investment back in 2004 would now be worth $478,249.

With Rocket Lab and other companies showing promise, the market provides multiple avenues for savvy investors to explore.

Stay informed and invest wisely!