# Navigating the Stock Market: Job Reports, Fed Policy, and the Gold Landscape

As seasoned investors at *Extreme Investor Network*, we understand the critical interplay between employment data, monetary policy, and commodity prices. With recent reports indicating a strong job growth landscape, savvy investors must assess how these factors may influence trading strategies on Wall Street. Let’s delve deeper into these dynamics and what they mean for your investment portfolio.

## Job Growth, Unemployment, and Rate Cuts: A Delicate Balance

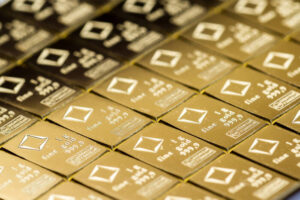

The latest job report has sent ripples through the market. If it prints strong job growth alongside a steady unemployment rate, investor expectations for a rate cut this December could diminish. In such a scenario, we might witness a robust dollar, which often weighs on gold prices as it raises the opportunity cost of holding non-yielding assets. Why does this matter? A strong dollar can deter investments in commodities, including gold, which many view as a hedge against inflation.

On the flip side, should we find weaker-than-expected job numbers, the market could shift dramatically. This outcome could bolster expectations for a more dovish Federal Reserve, softening the dollar and subsequently providing support for gold prices as investors seek out safe-haven assets.

## Inflation’s Role in Fed Decision-Making

The performance of the core Personal Consumption Expenditures (PCE) index has been under the microscope. Recent data reflects ongoing inflationary pressures that may complicate the Federal Reserve’s approach to monetary policy. A surprising twist has surfaced, with market expectations suggesting a 66% chance of a 25-basis-point rate reduction in December.

Why should you care? Understanding the Fed’s stance on interest rates is vital for anyone with exposure to the stock market. The dollar’s behavior—having soared recently on the prospect of sustained elevated interest rates—could define trading strategies moving forward. Indeed, stronger-than-expected jobs data could reinforce the belief in tighter Fed policy, further enhancing the dollar’s strength and potentially capping gold’s gains.

## Geopolitical Tensions: A Lifeline for Gold?

While early optimism surrounding ceasefire discussions in the Middle East dampened demand for gold, ongoing geopolitical risks, particularly the Russia-Ukraine conflict, maintain a floor for bullion prices. Market sentiment can shift quickly in response to these tensions, signaling renewed demand for gold as a safe haven.

From a strategic standpoint, capturing these moments can be vital. Investors should remain vigilant and ready to respond to news cycles that heighten risk aversion, prompting a renewed interest in gold. It’s during these periods that gold can reclaim its standing as a hedge against uncertainty.

## What Lies Ahead for Gold Prices?

As we look toward next week, the interplay of job data, inflation, and geopolitical risks will shape the trajectory of gold prices. Depending on which way the winds blow, investors could be faced with either opportunities or challenges.

For those looking to stay ahead, we recommend closely monitoring these economic indicators and remaining agile in your trades. Understanding the relationships between these markets can provide you with a competitive edge and help you make informed decisions when it counts.

At *Extreme Investor Network*, we strive to keep you updated with these insights and empower your investment journey. Stay connected with us for expert analysis and market updates that matter.

This rewritten content guides readers through the nuanced relationships between job data, inflation, and gold prices while establishing a connection to Extreme Investor Network’s expertise. It maintains an engaging and informative tone, making readers more likely to value the insights provided.