Nvidia’s Thrilling Q3 Report: A Deeper Look at the Numbers and What Lies Ahead

Nvidia (NASDAQ: NVDA) continues to impress the market, showcasing a remarkable trajectory in 2024. With the clock ticked to the results of its fiscal 2025 third-quarter earnings, investors were on edge, eagerly anticipating a continuation of the company’s impressive growth story. And what a story it has been! On November 20th, Nvidia revealed record-breaking revenue figures that left analysts and investors buzzing.

A Record-Breaking Revenue Surge

Nvidia’s fiscal Q3 results showcased a jaw-dropping revenue of $35.1 billion, a staggering 94% increase compared to the same quarter last year. This surpassed the company’s own guidance of $32.5 billion and blew past consensus expectations of $33.17 billion. In addition to the revenue, Nvidia’s non-GAAP earnings jumped to $0.81 per share, marking a 103% increase from the previous year, again exceeding the anticipated figure of $0.75.

But stock market reactions can be curious. Despite the stellar report, Nvidia shares took a slight dip in the days following the announcement, leaving many to wonder: Is this merely a bump in the road, or is there more to the story?

Understanding the Investor Reaction

Two key factors can explain the initial negative reaction. First, Nvidia’s projected revenue for the current quarter signifies a year-over-year growth of nearly 70% from last year’s $22.1 billion. While impressive, it does signal a deceleration compared to previous quarters’ explosive growth. Second, the anticipated non-GAAP gross margin for the upcoming quarter is forecasted at 73.5%, compared to last year’s 76.7%, triggering concerns over potential profit erosion.

However, discerning investors know that growth rates must be viewed in context. Nvidia remains a formidable player, especially when compared to its rivals. For instance, AMD is growing at a comparatively slower pace, underscoring Nvidia’s continued dominance in the semiconductor market.

Focusing on the Bigger Picture

There’s light at the end of the tunnel regarding Nvidia’s margins. This dip is part of strategic investments in ramping up production of the next-generation Blackwell AI processors. CFO Colette Kress highlighted during the earnings conference, "Our current focus is on ramping to strong demand, increasing system availability, and providing the optimal mix of configurations to our customers." The slight reduction in margins is a temporary measure, with Nvidia confidently projecting that Blackwell’s margins will stabilize in the mid-70s once production levels catch up to demand.

The company has revealed staggering demand for its Blackwell processors, which bodes well for its future. Nvidia is gearing up to exceed its previous production expectations for these chips in 2024. The projection here is clear: quarterly revenue from Blackwell is slated to surpass that of the previous Hopper architecture by April 2025.

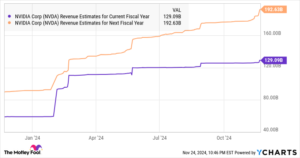

Solid Projections Ahead

With fiscal Q4 guidance in hand, Nvidia aims to finish the year with $123.5 billion in total revenue. Analysts are growing optimistic, as Nvidia’s revenue estimates for fiscal 2026 are trending upward. Expectations suggest the company’s bottom line could grow another 48%, reaching $4.27 per share in fiscal 2026. With consistent outperformance in earnings estimates over the past year, there’s reason to be bullish about the sustained demand for Blackwell processors.

Currently trading at 33 times forward earnings—just above the Nasdaq-100’s multiple of 31.3—Nvidia maintains a competitive valuation. As its earnings and demand grow, there’s potential for its stock price to reflect that success, resulting in an opportunity for significant upside in 2025.

Seize the Opportunity with “Double Down” Stocks

Investors often feel the pinch of missed opportunities when it comes to big-name stocks. However, at Extreme Investor Network, we strive to offer insights that can turn that sentiment around. Our expert analysts periodically issue "Double Down" alerts for companies poised for explosive growth.

Consider this: If you had invested $1,000 in Nvidia back in 2009 when we first called it out, that investment would now be worth a jaw-dropping $350,915. With three new “Double Down” opportunities currently in the mix, this could be the perfect moment to explore these exciting prospects.

For savvy investors, Nvidia’s temporary setbacks may offer a perfect buying opportunity as it continues its ascent in the tech landscape. Don’t miss your chance to capitalize on what could be the next big wave in the market!

Explore our top “Double Down” stocks and position yourself for success today!