Nvidia’s (NASDAQ: NVDA) stock has been on an incredible journey this year, surging an astonishing 196% in 2024 alone. With such impressive gains, all eyes are anxiously fixed on the upcoming fiscal 2025 third-quarter earnings report, set for release on November 20. Investors and market analysts alike are eagerly awaiting insights into how the semiconductor powerhouse will continue its trajectory, particularly around its thriving artificial intelligence (AI) segment.

Before we delve deeper into what to expect from Nvidia’s next earnings report, let’s take a moment to reflect on the company’s historical performance right after its last four quarterly releases. Understanding these patterns can provide valuable context for gauging how the stock might react following the upcoming news.

### Nvidia’s Recent Earnings Performance

Below is a snapshot of Nvidia’s past four earnings reports:

| Date | Period | Revenue (in $ billion) | Year-over-Year Change | Earnings per Share | Year-over-Year Change | Immediate Stock Price Change |

|————-|—————|————————|———————–|———————|———————–|——————————-|

| Nov. 21, 2023 | Q3 FY2024 | $18 | 206% | $4.02 | 593% | -2% |

| Feb. 21, 2023 | Q4 FY2024 | $22 | 265% | $5.16 | 486% | +16% |

| May 22, 2024 | Q1 FY2025 | $26 | 262% | $6.12 | 461% | +9% |

| Aug. 28, 2024 | Q2 FY2025 | $30 | 122% | $0.68 | 152% | -6% |

The stock’s fluctuations post-earnings releases indicate how investors interpret growth momentum against a backdrop of expectations. For instance, last year’s Q3 report saw Nvidia’s share price dip despite a positive revenue outlook due to geopolitical uncertainties, namely U.S. export restrictions that stoked worries regarding the company’s operations in China.

Fast forward to the most recent report in August, where despite significant year-over-year revenue gains, the stock price fell by 6% post-release. Wall Street appeared to recalibrate its expectations after several quarters of heady growth, resulting in a momentary setback within the stock that has since elevated its long-term trajectory.

### Setting the Stage for November 20

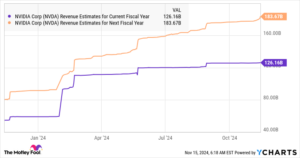

As we look ahead to November 20, Nvidia is gearing up to report its Q3 FY2025 results with guided expectations of $32.5 billion in revenue, which would represent an impressive growth of 80% year-over-year. While this figure signals solid performance, it suggests a potential deceleration compared to the double-digit growth rates experienced in preceding quarters. Investors are advised, however, to maintain a big-picture perspective: an 80% increase still underscores robust demand for Nvidia’s market-leading AI chips.

With its ongoing dominance—holding roughly 95% of the AI chip market share—Nvidia continues to set the bar. Its Blackwell AI processors are expected to revolutionize their market offering, with analysts projecting potential sales reaching $200 billion in the coming fiscal year. Such figures could not only give a significant boost to Nvidia’s revenue but may also pave the way for the stock to sustain its upward momentum.

Reflecting on the competition, while AMD has reported notable revenue growth, it remains to be seen if they can effectively rival Nvidia’s foothold in the AI domain. Thus far, AMD’s performance pales in comparison—an 18% year-over-year revenue increase versus Nvidia’s impressive growth figures.

### Final Thought: What Lies Ahead

Investors looking to capitalize on Nvidia’s growth story should keep a close ear to the ground and readiness to adjust their strategies following the November earnings report. The emphasis should be on the long-term potential amid short-term fluctuations. Properly navigating these dynamics could open doors to lucrative investment opportunities.

It’s also worth considering our latest “Double Down” stock recommendations—these alerts are our expert analysts’ picks for companies poised for remarkable growth, just like Nvidia has demonstrated over the years. These recommendations could serve as a safety net for investors who feel they may have missed their chance with trending stocks like Nvidia.

Don’t let market volatility discourage your investment strategy. In such an evolving landscape, vigilance and informed decisions can make all the difference. Join us at Extreme Investor Network for exclusive insights and strategies designed for savvy investors.

Stay tuned for Nvidia’s earnings release—it’s sure to be a significant moment in the market!