The Impacts of Global Economic Sentiment on U.S. Treasury Sales

In a notable turn of events, two of the largest holders of U.S. government debt—Japan and China—made headlines by substantially reducing their Treasury holdings during the third quarter of 2023. As November’s presidential election approached, these significant actions are reshaping the landscape of U.S. debt markets, prompting discussions that investors should not overlook.

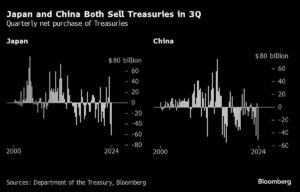

According to recent data from the U.S. Department of the Treasury, Japanese investors sold an unprecedented $61.9 billion in Treasuries between July and September, marking a record high for such divestiture. Meanwhile, Chinese investors also took defensive measures, offloading $51.3 billion—a significant but not record-setting maneuver within this timeframe.

The wave of selling corresponds with a peak in Treasury yields, reaching a 2.5-year high in mid-September. The sudden drop in Treasuries by nearly 4% can largely be attributed to worries over how President-elect Donald Trump’s anticipated economic policies—specifically, low taxes and high tariffs—might influence inflation rates. Such fears have raised critical questions about the future value of these securities, sparking defensive strategies among foreign investors.

Shoki Omori, chief Japan desk strategist at Mizuho Securities Co. in Tokyo, pointed out that the collective selling from banks and pension funds in Japan was fundamentally driven by the specter of a Trump victory and rising U.S. yields. Given the geopolitical climate, this has become a significant concern that also resonates with investors in China, who are increasingly cautious.

Interestingly, Japan’s heavy selling may have been partly prompted by its own currency market interventions. In July, Japan’s Ministry of Finance engaged in a significant operation where it sold dollars to purchase yen, amounting to approximately ¥5.53 trillion (around $35.9 billion). Such moves illustrate how domestic economic policy can ripple through foreign investment strategies and Treasury holdings.

Moreover, as China maneuvered its sales, the dynamics shifted as well. The use of custodial accounts led to a peculiar situation where Belgium—often seen as a haven for such accounts—recorded a notable purchase of $20.2 billion in Treasuries in September. This counterintuitive buying behavior in response to Chinese selling highlights the complexities of international finance and the nuanced relationships between various investors and countries.

Further complicating the scenario are uncertainties surrounding President Trump’s potential Treasury Secretary appointment. The prospect of inflationary policies, coupled with a resilient U.S. economy, is causing analysts to predict a continued increase in U.S. yields. Nick Twidale, chief analyst at AT Global Markets in Sydney, articulated that this trend reinforces expectations for ongoing Treasury sales from both China and Japan.

What does this mean for everyday investors? Understanding these foreign divestitures can provide critical insights into U.S. economic health and future policy directions. As the situation unfolds, it will be essential for investors to keep a close eye on geopolitical developments, changes in fiscal policy, and their potential ramifications on the Treasury market.

In a rapidly evolving economic landscape, staying informed and adaptable is key for smart investing. At Extreme Investor Network, we believe that understanding these global shifts not only prepares you for volatility but also empowers you to harness opportunities as they emerge. Keep following our insights for more exclusive, depth-oriented analyses tailored to help you navigate the complexities of the investment world.