In a recent update on Asian equities by Bloomberg, the climb in the market was supported by some positive signs in China’s economy and a retreat in the dollar. This news comes as a welcome relief after a week of uncertainty and sell-offs.

At Extreme Investor Network, we understand the importance of staying informed about global market trends to make the best investment decisions. The MSCI Asia Pacific Index saw a 0.4% increase, marking its first gain of the week. This growth was fueled by data revealing strong retail sales in China, along with a slower decline in property prices. Japanese benchmarks also saw gains of around 0.8%, thanks to a weakening yen.

The recent halt in the dollar’s five-day gain, as stated by Federal Reserve Chair Jerome Powell’s comments, has provided some respite for emerging market assets. At Extreme Investor Network, we prioritize analyzing such shifts in the market to guide our investors towards profitable opportunities.

Salman Niaz, head of global fixed income for APAC ex-Japan at Goldman Sachs Asset Management, highlighted the appeal of hard currency in emerging markets amid the current scenario of a stronger dollar. With expectations of a December rate cut and potential cuts in the upcoming year, Extreme Investor Network emphasizes the importance of diversifying your investment portfolio to leverage such market dynamics.

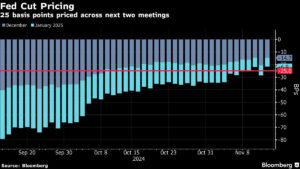

Looking ahead, US two-year yields remained stable after a surge in the previous session, signaling a cautious approach towards interest rate cuts. Retail sales data release and speeches from Fed officials will provide further clarity on the Federal Reserve’s future actions.

Amidst all these market movements, it is crucial to monitor global economic indicators and company earnings reports closely. Companies like Alibaba Group Holding Ltd. and JD.com Inc. are releasing their earnings, offering insights into the health of the Chinese consumption market.

Furthermore, at Extreme Investor Network, we recognize the significance of keeping an eye on commodities. Oil prices are facing downward pressure from a strong dollar and concerns of a potential glut next year. Gold, on the other hand, is holding steady near a two-month low, reflecting investors’ risk sentiments in the market.

As we continue to navigate through the complex world of finance and investments, Extreme Investor Network remains committed to providing our readers and investors with in-depth analysis and strategic insights. Stay tuned for more updates and exclusive content on our platform to make well-informed financial decisions.