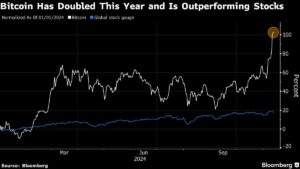

Bitcoin has been on a rollercoaster ride following the recent election of President-elect Donald Trump. The digital asset surged by about 30% after Trump’s victory on November 5th, hitting an all-time high of $89,968. However, as traders assess the impact of Trump’s support for crypto, Bitcoin has slightly dipped to $86,550.

One of the main reasons behind Bitcoin’s rally is Trump’s pledge to create a friendly regulatory environment for crypto, establish a strategic Bitcoin stockpile, and position the US as the global hub for the industry. Despite being a former skeptic of cryptocurrencies, Trump’s change of heart has boosted optimism in the market, leading to an all-time high valuation.

Despite the positive sentiment surrounding crypto, there are still lingering questions about whether Trump’s focus will shift to larger issues like China policy and the US economy, potentially delaying digital-asset legislation. As noted by IG Australia Pty Market Analyst Tony Sycamore, while further gains are possible, much of the good news may already be factored into the current price.

In the world of crypto, Dogecoin has been a standout performer recently, rising by approximately 80% in the past five days. This token, championed by billionaire Elon Musk and embraced by meme-crowds, experienced a brief surge following Trump’s announcement of a Department of Government Efficiency run by Musk. However, it has since followed Bitcoin’s downward trend.

Looking ahead, the focus in global markets is shifting towards upcoming US inflation data, which could impact the Federal Reserve’s decisions on interest rates. With Treasury yields and the dollar on the rise due to Trump’s proposed policies, there are concerns about inflationary pressures and higher borrowing costs that could pose challenges for riskier investments like crypto.

Despite these uncertainties, the crypto market maintains a relatively muted leverage, reducing the risk of a significant correction. Noelle Acheson, author of the Crypto Is Macro Now newsletter, believes that while a market breather may occur, the strong tailwinds driving the industry forward will likely lead to a quick rebound.

In conclusion, the recent developments in the crypto market have been influenced by Trump’s supportive stance and upcoming economic factors. The future remains uncertain, but the underlying strength of the industry suggests that any setbacks may be temporary. Stay tuned for more updates on Extreme Investor Network as we continue to monitor the evolving landscape of finance and investing.