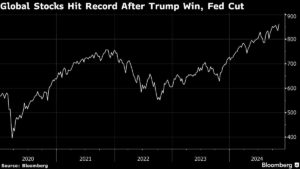

As the Federal Reserve cut interest rates, it sparked a significant rally in US stocks, bonds, and commodities, leading to Asian equities climbing on Friday. Australian and Japanese shares, along with Hong Kong futures, all advanced as the S&P 500 and Nasdaq 100 set new peaks for a second consecutive day. The Golden Dragon index of US-listed Chinese companies also surged by 3.5%, contributing to an overall increase in global equities to a record high.

The initial fears of inflation under a Donald Trump administration were somewhat soothed after the Fed lowered its benchmark rate by 25 basis points, causing Treasury yields to fall, particularly the 10-year yield by 11 basis points in US trading. The positive sentiment was reinforced by comments from Fed Chair Jerome Powell, who emphasized the strength of the US economy and maintained a cautious stance on a December rate cut. Powell’s reassurance about the economic stability of the US resonated with investors, showcasing a sense of confidence in the current economic landscape.

In addition to the positive mood in the markets, investors are also closely monitoring China as a legislative meeting concludes, potentially resulting in new stimulus measures to counteract any adverse effects of US trade levies. Chinese banks are increasingly venturing into higher-yielding offshore loans for mainland firms due to falling rates at home amidst monetary easing policies.

On a separate note, Japanese automaker Nissan Motor Co. announced plans to lay off 9,000 workers and reduce a fifth of its manufacturing capacity after experiencing a sharp decline in net income. Meanwhile, South Korea vowed to enhance its oversight of financial markets and respond proactively to mitigate excessive volatility.

Looking ahead, investors are keen on observing the outcome of China’s legislative meeting and any potential stimulus measures that may be announced. As the global economic landscape continues to evolve, staying informed about key market movements and developments is vital for making informed investment decisions. Stay tuned for more updates from the Extreme Investor Network to stay ahead in the world of finance and investing.