With Donald Trump’s election victory, the landscape of money flows in Asia is expected to shift, particularly with the looming threat of tariffs affecting Chinese assets. As investors assess Trump’s anti-China stance, there is a possibility of funds flowing into India and Japan, as highlighted by Morgan Stanley’s preference for shares in these two nations over China.

India, often seen as a manufacturing alternative to China, is appealing to investors due to its relative immunity to global risks and a domestic-driven economy. On the other hand, Japanese stocks are anticipated to benefit indirectly from Trump’s reflationary economic policy, which is expected to keep interest rates high, boost the dollar, and weaken the yen, ultimately favoring Japan’s exporters.

According to veteran emerging-market investor Mark Mobius, supply chains moving away from China could benefit not only Japan and India but also other countries, especially in Southeast Asia. India stands out as a significant beneficiary, given its workforce size and labor costs that can match those of China.

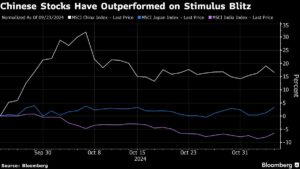

Wednesday’s price action in Asia signaled possible future trends, with the MSCI Japan Index and the MSCI India Index rallying while the MSCI China Index slumped. The threat of tariffs adds complexity to Beijing’s efforts to stimulate the economy and improve market sentiment, making the ongoing legislative meeting in China crucial for investors.

With Chinese stocks already under pressure leading up to the US election, the potential impact of higher tariffs on Chinese goods could dampen growth in the nation. Despite differing views on China’s prospects among investors, maintaining an overweight position on Japan and underweight view on China, as well as favoring Australia and India, seems to be a common strategy.

While some investors remain optimistic about China’s future, concerns about excessive currency moves and potential intervention for Japan, and economic and earnings growth slowdown for India, also exist. However, in the short term, the Trump trade could tactically benefit India in terms of foreign flows, though challenges in sustaining that rally may arise.

At Extreme Investor Network, we keep a close eye on global market trends and provide unique insights to help investors navigate through changing financial landscapes. Stay informed and ahead of the curve with our expert analysis and recommendations.