The recent snap election in Japan has had a significant impact on the yen and Japanese stocks. As the Liberal Democratic Party and its coalition partner faced a setback, the yen plummeted to a three-month low, weakening by as much as 0.6% against the dollar. This decline, coupled with four consecutive weeks of losses, has raised concerns about authorities intervening in the currency market to support the yen.

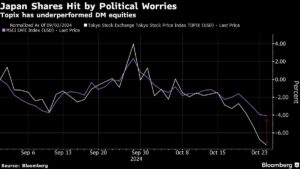

While a depreciating yen typically benefits Japanese stocks, investors are worried about the political stability and the potential impact on Prime Minister Shigeru Ishiba’s position. Futures for the Nikkei 225 indicated a potential drop of over 1% at the start of trading. Tadashi Matsukawa, from PineBridge Investments Japan Co., predicts a fall in stock prices and a decline in the value of the yen, with the possibility of bond yields also decreasing.

The election results showed that the LDP and Komeito fell short of the majority needed in the lower house, leading to concerns about the legislative process and its impact on the yen and the Nikkei. The yen, already the worst performer among the Group-of-10 currencies this year, has depreciated more than 7% against the dollar.

Atsushi Mimura, Japan’s top currency official, expressed urgency in monitoring the currency movements, given the recent slide. The yen traded at 153.70, a level not seen since July, prompting analysts like James Salter of Zennor Asset Management to suggest further weakness in the yen and potential ‘carry trade’ concerns.

Japanese stocks, which had hit record highs in July, have been struggling, with defense stocks expected to be impacted as they had seen gains on expectations of increased security spending under Ishiba. However, some analysts, like Nicholas Smith from CLSA Securities Japan Co., point out that Ishiba had initially mentioned higher taxes, and a weaker LDP might make it harder for him to implement such measures, which could be positive for the markets.

The current market sentiment leans towards wanting the current coalition to remain in power to allow the corporate sector to continue restructuring without political disruptions. As the situation unfolds, investors will be closely watching for further developments and potential market volatility.

Stay updated on the latest financial news and market trends with Extreme Investor Network. Join our community of savvy investors to gain valuable insights and strategies for navigating the ever-changing financial landscape.