As President Xi Jinping emphasized the importance of technology development, Chinese stocks saw a significant uptick in the market. This boost in confidence was also fueled by a series of statements from the central bank, indicating a positive outlook for policy support in the near future.

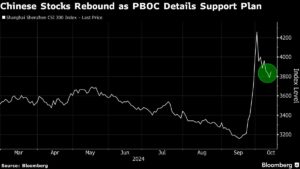

The CSI 300 Index closed up 3.6%, marking a strong rebound from a recent three-day loss. Chip shares led the way, with a gauge of Chinese tech stocks listed in Hong Kong surging more than 7% at its session high.

President Xi’s comments about the role of science and tech in Chinese modernization were particularly well-received by investors. This led to a 20% gain in chipmakers like Semiconductor Manufacturing International Corp. and Cambricon Technologies Corp.

In addition, the People’s Bank of China introduced a specialized re-lending facility to assist companies in buying back shares and a swap facility to provide liquidity for institutional investors looking to purchase stocks. These measures demonstrate the PBOC’s commitment to following through on promises made during a briefing in September.

Market experts like Xu Dawei, a fund manager at Jintong Private Fund Management in Beijing, view President Xi’s remarks as a significant driver of the market rebound. Combined with the PBOC’s initiatives, these developments are expected to help sustain positive momentum in the market.

However, despite these positive signals, the need for accelerated stimulus implementation remains evident. Fresh data released on Friday highlighted the necessity for increased stimulus efforts to reach the annual growth target, especially with economic expansion slowing in the third quarter.

While the central bank’s measures have provided a temporary boost to market sentiment, sustained gains may require a more robust expansion in fiscal spending. Investors remain cautious, as authorities have previously delivered only piecemeal steps after the initial stimulus package unveiled in September.

The onshore equity benchmark slipped into correction territory following a high-profile press briefing that failed to deliver significant measures to support the property market. This has led to differing opinions among experts on whether investors should continue chasing the current rally.

As the market continues to evolve, it’s essential for investors to stay informed and adapt their strategies accordingly. By monitoring policy developments, central bank statements, and economic data, investors can make more informed decisions about their investment portfolios.

At Extreme Investor Network, we provide in-depth analysis and expert insights to help you navigate the complex world of finance and investment. Stay tuned for more updates and actionable tips to help you achieve financial success in today’s dynamic market environment.