TSMC Boosts 2024 Revenue Target as Quarterly Results Exceed Expectations

Taiwan Semiconductor Manufacturing Co. (TSMC) has raised its target for 2024 revenue growth after posting quarterly results that surpassed estimates. This announcement has helped alleviate concerns surrounding global chip demand and the sustainability of the AI hardware boom.

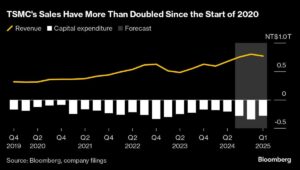

As the main chipmaker for Nvidia Corp. and Apple Inc., TSMC now expects sales to increase by 30% this year, a significant hike from previous projections of a maximum mid-20% rise. This optimistic outlook follows the company’s better-than-expected earnings for the September quarter. TSMC also anticipates a capital expenditure of slightly over $30 billion in 2024, aligning with earlier forecasts.

The increased revenue forecast from TSMC should ease worries about misjudging AI demand among investors. The company’s shares have surged by over 70% this year, outpacing many of Asia’s leading tech firms. This growth mirrors strong sales of Nvidia Corp. chips, which are essential for artificial intelligence development.

Earlier in July, Taiwan’s largest company had already raised its revenue expectations for 2024. This upward revision underscores the anticipation of increased spending on AI infrastructure from tech giants like Microsoft Corp. and Amazon.com Inc. The continued adoption of artificial intelligence is also expected to drive sales of iPhones and other electronic devices in the long term.

Investors had been keeping a close eye on TSMC’s outlook following reports of lower-than-expected orders from major supplier ASML Holding NV. While ASML cited a slower-than-anticipated recovery in the automotive, mobile, and PC markets impacting its expansion plans for chip plants, it identified AI as a bright spot.

In its latest earnings report, TSMC unveiled a better-than-projected 54% increase in September-quarter earnings. Despite the official trading of the company’s American depositary receipts not yet underway, the ADRs saw a 4.5% increase on Robinhood’s overnight trading platform. TSMC is particularly popular among US retail investors looking to capitalize on the AI trend.

Insights from Bloomberg Intelligence indicate that TSMC’s revenue outlook in the short to medium term remains robust, buoyed by strong demand for its 2- and 3-nanometer technologies from leading tech companies like Nvidia, AMD, Apple, and Qualcomm. The company’s superior production yields, enhanced EUV machine productivity, and leadership in 2.5D and 3D packaging continue to provide additional sales support.

As a key player in the global AI development race, TSMC’s market capitalization briefly exceeded $1 trillion in the US. Though concerns about the sustainability of global AI spending persist, TSMC seems to be on track with its rapid international expansion plans.

With more plants in Europe focusing on AI chip markets and ongoing construction in Japan, Arizona, and Germany, TSMC is poised to maintain its position as a leader in the chip manufacturing industry.

At Extreme Investor Network, we remain committed to providing valuable insights and analysis on the latest developments in the finance and investment landscape. Stay tuned for more exclusive content and market updates to help you make informed investment decisions.