As investors worldwide continue to monitor the fluctuations in the stock market, the recent selloff in the US has sparked a downward trend in Asian markets. The question on everyone’s mind is whether the artificial intelligence rally that has been driving the bull market is beginning to lose steam.

At Extreme Investor Network, we understand the importance of staying informed about the latest market trends and how they can impact your investment decisions. Our team of experts closely monitors global economic developments to provide you with valuable insights that can help you navigate the ever-changing financial landscape.

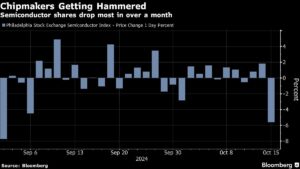

In Asia, the MSCI’s Asia Pacific Index has fallen for the third consecutive session, with major stock markets in Sydney, Tokyo, and Seoul all displaying losses. Chinese stocks have also seen a significant decline, with some key players in the semiconductor sector, such as SK Hynix Inc. and Samsung Electronics Co Ltd, experiencing drops in their stock prices.

The recent pullback in the European tech sector has had a ripple effect on Wall Street, leading to a cautious outlook in Asian markets. The optimism surrounding Chinese stimulus measures seems to have waned, prompting investors to take profits rather than maintain bullish positions on Chinese equities.

Despite the overall market downturn, there have been some bright spots, such as the resilience of Chinese property shares amid the broader market decline. Investors are eagerly anticipating a press briefing scheduled for Thursday, where more details on measures to support the struggling real estate sector are expected to be revealed.

Looking ahead, concerns about the volatility in Chinese stocks persist, as expectations grow for additional stimulus measures to rejuvenate the economy. In the US, the S&P 500 and Nasdaq 100 have also experienced losses, with the dollar seeing some stability after reaching a two-month high.

Elsewhere, oil prices have seen fluctuations, driven by geopolitical tensions in the Middle East and China’s efforts to bolster its economy. Traders are closely monitoring these developments, along with other key events scheduled for the week, such as Morgan Stanley earnings and the ECB rate decision.

At Extreme Investor Network, we aim to provide our readers with unique insights and analysis that can help them make informed investment decisions in a rapidly changing financial landscape. Stay tuned for more updates and expert commentary on the latest market trends and developments.