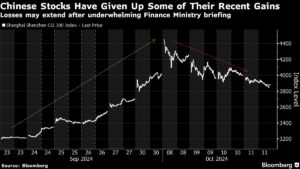

The recent Finance Ministry briefing in China over the weekend left investors cautious as it failed to provide concrete details on additional stimulus measures for the struggling economy. This, combined with a drop in factory prices, has added to concerns about China’s economic outlook.

Looking ahead, Chinese markets will be closely monitored as Finance Minister Lan Fo’an hinted at increased support for the property sector and hinted at greater government borrowing. However, the lack of specific monetary figures has left investors anxious for more clarity.

Richard Franulovich, head of FX strategy at Westpac Banking Corp., noted that investors may be disappointed by the lack of immediate stimulus measures. The CSI 300 Index experienced its biggest weekly loss since late July, reflecting growing concerns about China’s growth prospects.

Despite the uncertainty in Chinese markets, the S&P 500 in the US closed at a record high, driven by a rally in big banks. The US dollar has been mixed against peers, with traders adjusting expectations on the pace of Federal Reserve rate cuts.

Looking ahead, key events this week include Chinese growth and retail sales data, as well as inflation readings in New Zealand, Canada, and the UK. Central banks in Thailand, the Philippines, and Indonesia will also announce policy decisions.

At Extreme Investor Network, we understand the importance of staying informed about global financial developments. Stay tuned for more insights and analysis on market trends and investment opportunities.