Costco Wholesale (COST), also known simply as Costco, is a household name in the world of big-box retail stores. Offering bulk items, household products, and groceries at discounted prices, Costco is a favorite among consumers looking to stock up on essentials. However, recent events have shed light on some potential challenges and limitations for the company moving forward.

During times of uncertainty, such as the COVID-19 pandemic, consumers often turn to stores like Costco to panic-shop, leading to an increase in sales for the company. While this may seem like a positive for Costco, it also raises questions about the company’s future potential. With a high valuation and low dividend yield, some investors may be hesitant to consider investing in Costco at this time.

One recent event that had a significant impact on Costco’s sales was the dock workers’ strike on America’s East and Gulf Coasts. The strike led consumers to stock up on essential goods, mimicking the panic-shopping behavior seen at the onset of the pandemic. While the strike has since been resolved, it undoubtedly provided a boost to Costco’s sales in September.

Additionally, Costco management noted a surge in shopping activity in September due to Hurricane Helene and port strikes. While these one-time events may have contributed to impressive sales numbers, it is important for investors to consider the sustainability of this growth. Costco’s e-commerce sales also saw a substantial increase, likely driven by shoppers ordering essential items online during times of uncertainty.

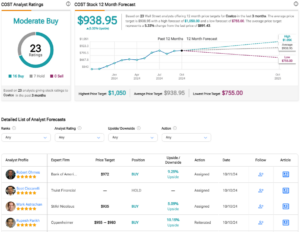

Despite the positive sales numbers, Costco’s stock valuation is a cause for concern. With a high P/E ratio compared to the sector median and a low dividend yield, investors may find Costco less attractive from a value and income perspective. Analysts are also cautious about Costco’s stock, citing lukewarm sentiment despite the recent sales performance.

Digging deeper into Costco’s financials reveals some potential yellow flags, such as a decrease in cash and cash equivalents and free cash flow. With tough comps and lower sequential results expected, investors may want to approach Costco stock with caution.

Ultimately, while Costco’s September sales were impressive, it remains to be seen how sustainable this growth is. As a consumer, shopping at Costco for essential items may make sense, but as an investor, the current valuation and future outlook may not be as appealing. For now, staying neutral on shares of Costco seems to be a prudent approach for investors looking to navigate the turbulent waters of the retail market.

At Extreme Investor Network, we provide unique insights and analysis that go beyond the surface-level information available on other platforms. Our expert team delves deep into the financial landscape to provide our readers with valuable perspectives that can help them make informed investment decisions. Consider subscribing to our platform for exclusive content that can help you stay ahead in the world of finance.