The recent economic data is making waves in the financial market, sparking a debate on the Federal Reserve’s next move.

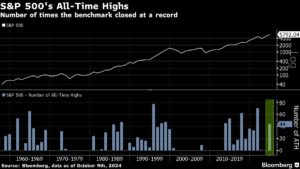

The debate centers around whether the Fed will opt for a smaller rate cut next month or pause after a large reduction in September. The S&P 500 seemed to take a breather after reaching all-time highs, following the release of economic figures indicating hotter-than-expected inflation and a slowdown in the labor market.

As the debate rages on, bond traders are still betting that the central bank will reduce the pace of cuts to 25 basis points in November. The core consumer price index increased 0.3% from August and 3.3% from a year ago, excluding food and energy costs. Additionally, applications for US unemployment benefits rose last week, reflecting large increases in several states.

According to Quincy Krosby at LPL Financial, the latest economic numbers present a challenge for the Fed. The combination of rising inflation amidst a cooling labor market is not ideal. This has led to discussions within the Fed about how to prioritize their mandates moving forward.

The market is closely watching key figures within the Federal Reserve, such as Atlanta Fed President Raphael Bostic and Richmond Fed President Thomas Barkin. Both have expressed their perspectives on inflation, with Bostic being open to a quarter-point cut next month, and Barkin acknowledging the progress in inflation while highlighting potential risks ahead.

Looking ahead, experts like David Donabedian at CIBC Private Wealth US still expect the Fed to cut rates by a quarter point in November, with a similar cut likely to follow at the December meeting. However, the road to reaching the inflation target set by the Fed is proving to be challenging.

On the corporate front, companies like Delta Air Lines Inc., Domino’s Pizza Inc., Pfizer Inc., GXO Logistics Inc., and Eli Lilly & Co. have been making headlines with updates on profits, sales, legal actions, and more.

As we navigate this landscape of economic uncertainty, staying informed on market trends and key events will be crucial. Keep an eye on upcoming earnings reports, economic data releases, and speeches from Fed officials to gain valuable insights into the ever-evolving financial landscape.

At Extreme Investor Network, we aim to provide unique and valuable information to help you make informed investment decisions in a dynamic market environment. Stay tuned for more updates and expert analysis on all things finance.