Micron Technology Inc. Surges on Strong Sales Forecast Amid AI Boom

Micron Technology Inc., the largest US maker of computer memory chips, is making waves in the tech industry with its latest sales and profit forecasts. In a recent statement, the company announced that fiscal first-quarter revenue is expected to reach approximately $8.7 billion, surpassing the average analyst estimate of $8.32 billion. Additionally, profit is projected to be around $1.74 per share, exceeding the expected $1.52 per share.

The robust outlook from Micron comes as a result of the increasing demand for artificial intelligence (AI) technology. Micron has been capitalizing on the AI boom by offering high-bandwidth memory products that provide rapid access to data, essential for developing AI systems. This surge in demand has allowed Micron to raise prices and secure long-term contracts, with products already sold out for the next few years.

The positive news has sparked investor interest, with Micron’s shares rising by about 14% in after-hours trading. The company’s strong performance in the fiscal fourth quarter, where revenue grew by 93% to $7.75 billion, further solidified its position in the market. Micron’s Executive Vice President of Operations, Manish Bhatia, attributed the company’s success to its ability to provide advanced memory solutions at scale, meeting the growing needs of AI-driven technologies.

Beyond the AI sector, Micron is also benefitting from the rebound in demand for personal computers and smartphones. As device shipments increase, the need for memory chips is growing, with AI functionality requiring even more memory. This trend is expected to further boost Micron’s earnings and market share in the coming years.

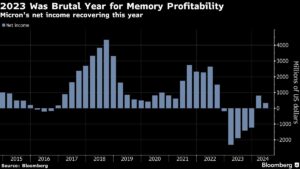

Micron’s CEO, Sanjay Mehrotra, expressed optimism about the company’s future, stating, “We are entering fiscal 2025 with the best competitive positioning in Micron’s history.” Despite the challenges of the industry’s boom-and-bust cycles, Micron has successfully navigated through downturns and emerged as a key player in the memory market, competing with industry giants like Samsung Electronics Co. and SK Hynix Inc.

As Micron continues to innovate and meet the increasing demand for memory solutions, investors can expect the company to remain at the forefront of the tech industry. Stay tuned for more updates on Micron’s growth and success as it continues to shape the future of AI technology.

Disclaimer: The information provided is for educational and informational purposes only, and does not constitute investment advice.