Extreme Investor Network: Unveiling China’s Stimulus Measures and Their Impact on Asian Stocks

In recent news, Asian stocks experienced a significant surge following China’s central bank’s announcement of stimulus measures. The primary goal of these measures is to achieve the economic growth target for this year and address the equity market’s downturn.

This boost was most notable in Hong Kong, where key benchmarks surged by at least 3%. Additionally, onshore Chinese indexes saw an increase of over 2%. These positive movements contributed to the MSCI Asia Pacific Index climbing by 0.7%.

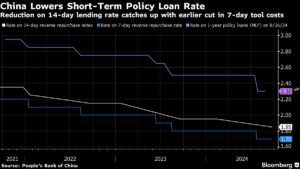

China’s strategy involves providing liquidity support of at least 800 billion yuan ($114 billion) to the stock market. Moreover, brokerages and funds will have the opportunity to access the central bank’s funding to purchase equities. These actions come as part of a broader set of policy measures aimed at revitalizing the economy. Included in these measures are a cut to a key short-term interest rate and decreased borrowing costs on up to $5.3 trillion in mortgages.

Despite the initial market response being favorable, analysts caution that the rally may not be sustainable. Some of the underlying issues affecting China’s economy, such as deflationary pressure, remain unresolved.

Siguo Chen, a portfolio manager at RBC BlueBay Asset Management, noted, “Short-term, it will help the market find a bottom, but long-term, I think we need to see more fiscal support.” This sentiment is echoed by many experts who emphasize the importance of continued government intervention in the market.

To further assist market participants, the People’s Bank of China will implement a swap facility enabling securities firms, funds, and insurance companies to access liquidity from the central bank for stock purchases. Market observers anticipate that these measures will enhance market liquidity and boost confidence, albeit temporarily.

The impact of China’s stimulus measures extends beyond Asian markets, as reflected in US stock futures, which saw a slight decline. This decline followed a 0.3% increase in the S&P 500 in the previous session, coming close to its all-time high from the previous week.

Looking ahead, market participants eagerly await data on the Fed’s preferred price metric and US personal spending later in the week to gauge the health of the world’s largest economy. Additionally, traders are betting on significant policy easing by year-end, indicating the likelihood of further rate cuts.

Chicago Fed President Austan Goolsbee emphasized the importance of focusing on the labor market as inflation trends towards the central bank’s target. This emphasis may result in multiple rate cuts over the next year. Conversely, Neel Kashkari at the Minneapolis Fed supports lowering interest rates by an additional half percentage point by year-end due to weaknesses in the job market.

In the midst of these developments, the Reserve Bank of Australia is expected to maintain its cash rate at a 12-year high, while gold prices hold steady near a record high. Amidst geopolitical tensions, oil prices inched higher following airstrikes on Lebanon by Israel.

The upcoming week will see several crucial events, such as interest rate decisions from various central banks and economic data releases from major economies. As investors remain attentive to these developments, market movements will continue to be influenced by global economic conditions.

Extreme Investor Network provides comprehensive insights into the latest financial market trends and updates, helping investors make informed decisions in a rapidly changing landscape. Stay connected with us for cutting-edge analysis and expert commentary on crucial financial developments. Join our network today to navigate the complexities of the financial world with confidence.