In the competitive world of business, what happens when a company’s biggest customers also become its most formidable competitors? Picture this scenario: you own the largest chocolate chip company in the country, supplying your tasty treats to all the major grocery store chains because your recipe is simply unrivaled. However, these very same stores are investing significant resources into developing their own chocolate chip recipes that could potentially outshine yours, leading to a sticky situation for your business.

This is the predicament that Nvidia, a leading technology company, finds itself in today. Tech giants like Microsoft, Alphabet (parent company of Google), Meta Platforms, and Amazon are not only major customers of Nvidia, purchasing billions of dollars worth of Nvidia GPUs, but they are also direct competitors in the development of similar products. The challenge for Nvidia now is to stay ahead of the curve and maintain its competitive edge in the face of such deep-pocketed rivals.

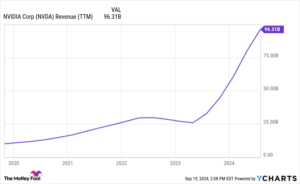

Alphabet, in particular, poses a significant threat to Nvidia’s market dominance. These four tech behemoths reportedly contribute nearly 40% of Nvidia’s revenue, which has surged to $96 billion in the past year. The bulk of this revenue, around 85%, comes from Nvidia’s data center division, with a substantial portion driven by sales to other tech giants.

Nvidia’s stronghold in the artificial intelligence (AI) chip market, estimated to be between 70% and 95%, is being challenged by Alphabet’s development of its Tensor Processing Unit (TPU) series. The latest sixth-generation TPU, Trillium, boasts impressive performance gains over its predecessor, offering five times greater speed and 67% improved energy efficiency.

One key advantage for Alphabet is its ability to offer TPUs through Google Cloud, giving it a wider reach and allowing customers to rent computing power rather than make substantial capital investments. This rental model provides stiff competition for Nvidia as companies may opt for a more cost-effective solution rather than purchasing dedicated hardware. Additionally, Alphabet leverages TPUs internally, further enhancing its competitiveness in the AI chip market.

From an investment perspective, Alphabet’s financial strength and profitability, particularly in its core advertising and cloud computing segments, position it well to fund its AI initiatives. Google Cloud’s impressive growth, characterized by a significant increase in operating margin, reflects strong demand and operational efficiency within this segment.

Despite the competitive landscape, Alphabet’s stock remains attractively priced relative to its historical valuations, presenting a compelling opportunity for tech investors seeking growth at a reasonable price. The company’s strategic investments in AI, cloud computing, and other innovative solutions underscore its long-term growth potential and ability to challenge Nvidia’s market dominance.

In conclusion, while the competition is fierce, Alphabet’s solid financial footing, innovative products, and strategic focus on emerging technologies make it a compelling contender in the AI landscape. For investors seeking exposure to the rapidly evolving tech sector, Alphabet’s stock offers a promising opportunity for long-term growth and value appreciation.