As investors eagerly await decisions from both the Federal Reserve and the Bank of Japan this week, the MSCI AC Asia Pacific Index experienced a slight decline, with Japanese stocks leading the way. Despite this, benchmarks for Australia and Hong Kong saw gains, providing some positive sentiment in the region.

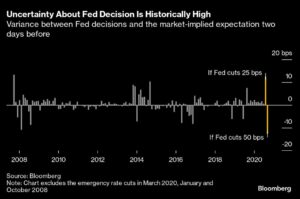

The Federal Reserve’s upcoming decision is highly anticipated, with expectations of a half-point rate cut on Wednesday. The recent weakening of US economic data has strengthened market predictions of a rate cut, however, the extent of the cut – either 25 or 50 basis points – remains uncertain. The upcoming US retail sales data release may offer further insights into the Fed’s upcoming decision.

In Hong Kong, the stock market debut of Chinese appliance giant Midea Group Co. saw a notable increase in share prices, indicating strong demand. Other IPOs in the region, such as Didi Global Inc., also hint at revived investor interest in Hong Kong’s market.

Concerns over China’s economic weakness persist, with disappointing economic data prompting discussions around potential fiscal and monetary stimulus measures to achieve this year’s growth target. Additionally, proposed tariffs by the US on Chinese goods, including medical products, have put pressure on certain industries.

Amidst public holidays in China, Taiwan, and South Korea, the yen has remained steady following its recent surge. Market expectations of a narrowing interest rate differential between the US and Japan have contributed to the yen’s appreciation, potentially impacting Japanese equities’ performance.

Despite the recent rally of the Japanese currency, the Bank of Japan is expected to keep rates unchanged during its upcoming meeting. This decision comes after two rate hikes earlier in the year, reflecting a cautious approach amid economic uncertainties.

Leveraged funds are divided in their positions on the yen, with some locking in profits ahead of monetary policy decisions, while others anticipate further strengthening of the yen. Entities like JPMorgan Chase & Co. have adjusted their yen forecasts, considering factors like interest rate normalization and dollar weakness.

In the commodities market, gold remains near record levels, benefitting from a weaker US dollar and lower Treasury yields. Silver prices have also seen an uptick, heading towards $31 an ounce in a seven-day positive streak.

Key events to watch this week include rate decisions in Germany, the UK, and Japan, as well as data releases on US retail sales and industrial production. These events have the potential to influence global markets and investor sentiment.

As traders navigate through market uncertainties and upcoming central bank decisions, staying informed and proactive in adapting investment strategies is key. Extreme Investor Network remains committed to providing timely insights and expert analysis to help investors navigate through volatile market conditions effectively.