In a volatile market environment filled with uncertainties, investors are constantly on the lookout for stocks that are well-positioned to weather the storm and deliver solid returns. With recent worries about sluggish growth and policy uncertainty, finding the right stocks can be a challenging task. However, there are potential tailwinds on the horizon, especially with anticipated cuts in the Fed’s key interest rates.

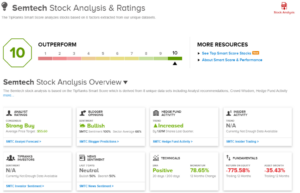

One valuable tool that investors can leverage to identify top-performing stocks is the Smart Score from TipRanks. This AI-driven tool scans the full volume of the stock market’s data and compares every public stock to a set of factors known to correlate with future outperformance. The result is a simple score for every stock on a scale of 1 to 10, with a ‘Perfect 10’ indicating stocks with solid upside potential.

At Extreme Investor Network, we use the Smart Score to identify top-scoring stocks that are worth a closer look. These stocks are not only rated as Strong Buys by Wall Street analysts but also have the coveted ‘Perfect 10’ Smart Score.

Let’s dive into the details of two such top-scoring stocks that investors should consider adding to their portfolios:

### Semtech Corporation (SMTC)

Semtech is a niche player in the semiconductor chip industry, offering a wide range of analog and mixed-signal chips that power smaller, faster, and smarter electronic devices. The company’s products cater to various applications, including wireless RF, circuit protection, signal integrity, broadcast video, professional AV, cellular IoT solutions, and power management.

Despite being a smaller company compared to industry giants, Semtech boasts impressive financials, with over $868.76 million in revenues for its fiscal year 2024. The company recently reported $215.4 million in revenues for its fiscal Q2 2024, beating expectations.

Baird analyst Tristan Gerra is bullish on Semtech, emphasizing the company’s strong positioning in various segments of the chip industry. Gerra’s Outperform (Buy) rating on SMTC shares comes with a $80 price target, implying a 97% upside potential.

With a Strong Buy consensus rating from the Street based on 11 recent reviews, Semtech is trading at $40.59, with an average price target of $56.44, suggesting a one-year upside of 39%.

### Rubrik, Inc. (RBRK)

Rubrik is a Silicon Valley tech firm specializing in cloud data management and data security systems. The company’s solutions are essential in today’s digital world, where businesses rely heavily on data and data analysis. Rubrik offers products for enhanced data security, protecting customers from cyberattacks and data breaches.

Following its IPO earlier this year in April, Rubrik has shown solid financial performance, with total revenues of $204.95 million in fiscal Q2 2025, up more than 35% year-over-year. Cantor analyst Yi Fu Lee is optimistic about Rubrik’s growth potential, recommending the stock as a top choice for investors interested in tech innovators.

Lee’s Overweight (Buy) rating on RBRK shares comes with a $50 price target, indicating a 62.5% one-year gain. With a unanimous Strong Buy consensus rating from 11 recent analyst reviews, Rubrik is trading at $30.75, with an average price target of $44.90, suggesting a 46% increase by next year.

At Extreme Investor Network, we believe that these top-scoring stocks, backed by strong analyst ratings and the Smart Score, offer excellent investment opportunities in the current market conditions. Stay informed with the latest market insights and stock recommendations on our platform.