If you’re on the lookout for discounted dividend stocks in the current market, you may have noticed that options are limited. With the S&P 500 still trading near record highs and having climbed more than 30% since November, bargains are hard to come by. However, with enough research, you can still uncover opportunities worth considering.

Here’s a closer look at three beaten-down S&P 500 dividend stocks that may present attractive entry points for investors:

-

United Parcel Service (NYSE: UPS)

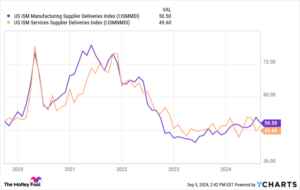

Despite facing challenges as the economy transitions away from the COVID-19 pandemic, United Parcel Service has seen its stock price decline by 45% from its early 2022 peak. Investors have been concerned about the return to in-person shopping and new labor contracts impacting the company’s performance. However, recent data shows that deliveries are on the rise, suggesting that UPS may be undervalued. With a forward-looking dividend yield of 5%, there’s potential for solid returns as revenue is expected to grow by nearly 5% next year. -

Devon Energy (NYSE: DVN)

Devon Energy, operating in the oil and gas industry, offers a forward-looking yield of 4.7%. While its dividend payments can fluctuate with earnings, the stock has pulled back by 22% from its peak in April, presenting a possible entry opportunity. As a direct play on oil prices, Devon Energy’s payout could benefit from increasing energy demand projections. Despite the sector’s volatility, the company remains committed to returning earnings to shareholders through dividends. - Franklin Resources (NYSE: BEN)

As a leading investment management firm, Franklin Resources has seen its stock price drop by 35% since late last year, pushing its projected dividend yield above 6%. While ETFs and individual stocks have gained popularity, traditional mutual funds remain a significant part of the investment landscape. With a history of revenue growth and dividend increases for 44 consecutive years, Franklin Resources continues to attract investors looking for steady income and long-term growth potential.

By exploring these opportunities, investors can diversify their portfolios with S&P 500 dividend stocks that have significant upside potential. While the market may lack discounts at the moment, thorough research and strategic investments can still lead to attractive returns in the long run.

As always, it’s important to conduct your own research and consult with a financial advisor before making any investment decisions. Extreme Investor Network is here to provide comprehensive insights and guidance on navigating the financial markets to help you achieve your investment goals.