As the world eagerly awaits the release of the US jobs data, traders are bracing themselves for potential impacts on the Federal Reserve’s interest-rate decisions and market movements. The dollar has weakened, and US stock futures are slightly down in anticipation of this highly anticipated report.

At Extreme Investor Network, we understand the importance of staying ahead of market trends and movements. Our team of experts closely monitors global economic developments to provide our readers with valuable insights and analysis.

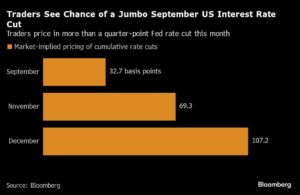

The possibility of a worse-than-expected payrolls outcome has fueled speculation that the Fed may implement a 50 basis-point cut this month. This has led to increased volatility in currency markets, with options for the dollar hitting the highest level since March 2023. Traders are cautious about short-term bets given the uncertainty surrounding the upcoming report.

In Asia, most currencies have strengthened, while Asian equities remain mixed. Treasury yields have edged lower, putting further pressure on the greenback. Market sentiment remains bearish on the US currency, with some experts predicting a potential test of the yen’s August high against the dollar.

This week, we are keeping a close eye on key events, including Eurozone GDP and the US nonfarm payrolls report. Our team will be closely monitoring these developments and providing our readers with expert analysis and insights to help them navigate the ever-changing financial landscape.

Stay informed and stay ahead of the curve with Extreme Investor Network. Join us as we delve deep into the world of finance, providing you with unique perspectives and valuable information to empower your investment decisions.