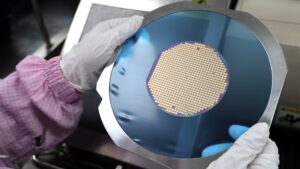

Investing in semiconductor companies may seem risky during times of market volatility, but Cantor Fitzgerald believes it is a smart move. According to analyst C.J. Muse, investors should stay the course and remain overweight in the semiconductor sector, despite recent ups and downs. While the PHLX Semiconductor Sector Index has seen some turbulence, it is still up 49% year to date.

At Extreme Investor Network, we understand the importance of staying informed during uncertain times in the market. That’s why we advise investors to pay attention to quarterly financial results, such as those from Nvidia, a key player in the AI industry. Nvidia’s earnings are seen as a barometer for the entire AI sector, so they are worth keeping an eye on.

In the midst of geopolitical risks and macroeconomic uncertainties, Muse suggests that investors stick with AI-focused companies like Nvidia, Broadcom, and Micron Technology. Additionally, he believes that ASML Holding and Western Digital may outperform the market. However, he is less optimistic about Qualcomm’s performance in the near future.

To navigate the volatile market, Muse recommends breaking down semiconductor revenues into categories like AI and memory. This strategic approach can help investors make more informed decisions and potentially mitigate risks during uncertain times.

At Extreme Investor Network, we believe in providing valuable insights and analysis to help investors make informed decisions. By staying on top of market trends and expert recommendations, investors can navigate market volatility with confidence and achieve long-term success in their investment journey.