As we eagerly anticipate CrowdStrike Holdings’ (NASDAQ: CRWD) second-quarter earnings report for fiscal 2025, investors are wondering if the cybersecurity company can bounce back after a tumultuous month that saw its stock plummet by nearly 40%. The recent software update mishap resulted in a massive outage, causing substantial losses for Fortune 500 companies like Microsoft and Delta Air Lines.

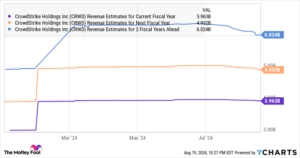

Analysts are closely watching CrowdStrike’s upcoming earnings report, scheduled for release on August 28, to gauge the extent of the damage the company faces. With revenue estimates for fiscal Q2 and the full year slightly lower than initially projected, investors are wary of the stock’s current valuation, which sits at a hefty 20.5 times sales, well above the industry average.

Given the uncertainty surrounding CrowdStrike’s future performance and the potential long-term impact of the recent incident on its balance sheet, caution is advised when considering an investment in the company ahead of the earnings report. It is recommended to wait for more clarity on the situation before making any significant decisions.

For investors seeking potentially lucrative opportunities, it may be worthwhile to explore our expert team’s insights on “Double Down” stock recommendations. These rare alerts highlight companies poised for significant growth and offer a second chance to capitalize on their success. Past recommendations like Amazon, Apple, and Netflix have delivered impressive returns, indicating the value of staying informed and seizing timely investment opportunities.

As we await CrowdStrike’s earnings report and navigate the current market conditions, it’s essential to stay informed and exercise prudence in our investment decisions. By leveraging expert insights and staying vigilant, investors can position themselves for success in the ever-changing world of finance.

Don’t miss out on the latest updates and expert recommendations from Extreme Investor Network to make informed investment decisions and maximize your financial potential. Stay tuned for more valuable insights and opportunities to grow your portfolio wisely.