As investors gear up for key events from the Federal Reserve and the Bank of Japan, European stocks are bracing for a pause in their recent momentum. This cautious sentiment is reflected in the little changed Euro Stoxx 50 futures and US equities contracts, as well as a slight pullback in the MSCI Asia Pacific Index.

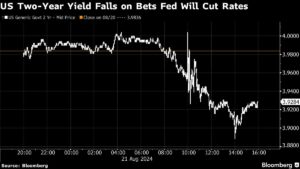

The anticipation is building ahead of Chair Jerome Powell’s speech at the Jackson Hole economic symposium on Friday. Recent dovish signals from the Fed have fueled speculations of a potential rate cut, with market strategist Jun Rong Yeap noting that “risk-taking may be capped for fears of any disappointment from the Fed chair.” This sense of uncertainty has also led to a stabilization in the US dollar following a recent selloff.

Meanwhile, all eyes will be on BOJ Governor Kazuo Ueda as he addresses lawmakers, particularly after the central bank’s hawkish signals contributed to global market turmoil earlier this month. The market is also digesting comments from Bank of Korea Governor Rhee Chang-yong, who hinted at a possible rate cut in the next three months.

On the corporate front, Xiaomi Corp.’s shares rallied more than 8% on the back of better-than-expected second-quarter results, providing support to a gauge of Chinese tech stocks. However, confidence remains fragile, with HSBC Holdings Plc strategist Herald van Der Linde cautioning that “we need to see some confirmation that earnings are holding up” for China to perform well.

In the US, a likely revision to job growth figures has added to expectations of a September rate cut. The Bureau of Labor Statistics is expected to revise down the number of workers on payrolls, further fueling speculations of Fed easing in the near future.

Looking ahead, investors will be closely monitoring key events such as Eurozone PMI data, US jobless claims, and Japan CPI figures. Market participants will also be keeping a close watch on developments in commodities, with oil and gold prices reacting to concerns about a US slowdown and expectations of a Fed rate cut.

As the week unfolds, stay tuned to Extreme Investor Network for in-depth analysis and unique insights into the latest market trends and developments. Our team of financial experts is dedicated to providing you with the most relevant and up-to-date information to help you make informed investment decisions. Subscribe to our newsletter and join our network of savvy investors today!