MTY Food Group: A Hidden Gem in the Restaurant Industry

MTY Food Group (OTC: MTYF.F) may not be a household name, but you’ve likely interacted with one of the over 90 snacking and restaurant brands it owns. From Papa Murphy’s to Cold Stone Creamery, MTY Food Group operates a diverse portfolio of quick-service, fast-casual, and traditional dining establishments.

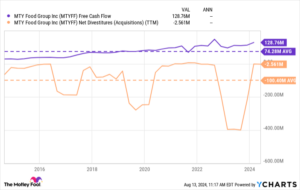

Despite flying under the radar, MTY Food Group has been a star performer in the stock market. With over 7,100 locations, the company operates primarily through a franchise model, leading to an asset-light, high-margin business. Over the years, MTY has consistently generated positive free cash flow (FCF) and delivered total returns of 3,600% since the early 2000s, significantly outperforming the S&P 500 index.

While the stock has recently dipped 40% from its high, savvy investors see this as a rare opportunity. MTY Food Group is a serial acquirer, having completed 50 acquisitions since 1999. Unlike companies that rely on megamergers for growth, serial acquirers like MTY often outperform the market. In fact, a recent study by McKinsey found that companies with a robust M&A strategy outperformed the broader market by 1.8%.

MTY Food Group’s disciplined approach to acquisitions has resulted in impressive financial metrics. With a return on invested capital (ROIC) averaging 15% over the past decade, the company continues to create value for its investors. Additionally, MTY has a history of consistent FCF generation and debt management, maintaining a healthy debt-to-adjusted EBITDA ratio of 2.6.

Moreover, MTY Food Group’s commitment to returning value to shareholders is evident through its steadily growing dividend. With a 251% increase in FCF-per-share over the last decade, the company has ample room for future dividend increases. Management’s share buyback program and significant insider ownership further demonstrate their dedication to creating shareholder value.

Currently, MTY Food Group presents a once-in-a-decade valuation opportunity. Its enterprise-value-to-EBITDA and enterprise-value-to-FCF ratios are near 10-year lows, offering an attractive entry point for investors. The company’s dividend yield of 2.5% is also well above its historical average, providing a steady stream of passive income for shareholders.

In conclusion, MTY Food Group may not be a high-growth stock, but its solid business fundamentals, serial acquisition strategy, and attractive valuation make it a compelling investment opportunity. For investors seeking a reliable dividend stock with long-term growth potential, MTY Food Group is definitely worth a closer look.

If you’re considering investing in MTY Food Group or other top-performing stocks, be sure to stay informed with expert analysis and recommendations from Extreme Investor Network. Our team of financial experts can help you build a successful investment portfolio and achieve your financial goals.