When it comes to companies worth more than $1 trillion, Eli Lilly (NYSE: LLY) might be the next one to achieve this impressive milestone. With a market cap of $885 billion, Eli Lilly is well on its way to joining the trillion-dollar club, possibly even before competitors like Berkshire Hathaway.

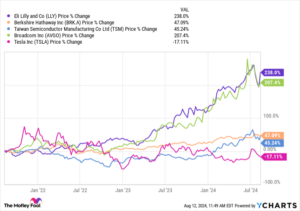

One of the key factors that set Eli Lilly apart is its exceptional pace of growth in recent years. While other potential trillion-dollar companies like Taiwan Semiconductor, Broadcom, and Tesla struggle to keep up, Eli Lilly continues to outpace its peers. This growth trajectory is reflected in the company’s financial results, with a 36% year-over-year increase in revenue and an 86% increase in adjusted earnings per share in the second quarter of this year alone.

Despite its impressive performance, some investors are concerned about Eli Lilly’s high forward price-to-earnings ratio (P/E) of 59.01. However, with analysts projecting an average annual EPS increase of 76% over the next five years, the company’s valuation could soon align with its growth potential.

Looking beyond the $1 trillion mark, Eli Lilly has a robust pipeline of innovative therapies that could drive future growth. With promising products like orforglipron and retatrutide in development, the company is well-positioned to maintain its leadership in key therapeutic areas like anti-obesity treatments.

Overall, Eli Lilly’s commitment to innovation and market-beating performance makes it a compelling investment opportunity for the long term. As the company continues to deliver value to shareholders, investors should consider the potential for substantial returns in the years to come.

Before investing in Eli Lilly, it’s essential to consider all factors and conduct thorough research. If you’re looking for more investment opportunities, the Motley Fool Stock Advisor service offers guidance on building a successful portfolio and provides regular updates on top stock picks. Don’t miss out on the next big opportunity in the market – start exploring today.