The week ended on a positive note for Asian shares, with stocks in Japan, South Korea, and Australia all seeing gains. This uptick in the market was fueled by optimistic signs in the US labor market, which also boosted US stocks.

One notable performer was the Topix index in Japan, which rebounded after steep declines earlier in the week. Tech and bank stocks led the way, contributing to the market’s recovery.

The positive sentiment was further supported by US jobless claims, which came in lower than expected. This data helped alleviate concerns about the labor market following last week’s disappointing jobs report, which had sparked fears of a global recession.

As the market continues to digest signals from policymakers, investors are paying close attention to statements from the Federal Reserve. Federal Reserve Bank of Kansas City President Jeffrey Schmid’s comments on Thursday indicated a reluctance to support interest rate cuts with inflation above target.

In Japan, Tokyo Electron Ltd. saw its shares surge after lifting its profit forecast for the fiscal year and reporting strong sales growth. The weakening of the yen against the dollar also provided a boost to Japanese stocks.

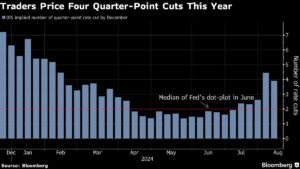

Meanwhile, treasuries remained steady in Asian trading, and there were indications that investors were trimming bets on aggressive Fed easing in 2024. Cryptocurrencies surged as investors returned to riskier assets.

Looking ahead, investors are waiting for China’s inflation and producer prices data, as well as updates on money supply and new lending. Inflation figures from China may influence demand for government bonds and impact speculation on further rate cuts from the People’s Bank of China.

In the commodities market, oil prices edged lower, while gold prices fell after a previous session gain. Following tensions in the Middle East, steel and aluminum producers in Canada were urging the government to impose tariffs on Chinese products to protect local jobs.

Overall, the market remains volatile as investors navigate through various economic signals and policy decisions. It’s essential to stay informed and strategic in navigating these fluctuations to make informed investment decisions.

Stay tuned to Extreme Investor Network for more updates and insights on the ever-changing world of finance and investing. Sign up for our newsletter to receive exclusive content and expert analysis tailored to help you maximize your investment potential.