When it comes to investing, there are different strategies to consider. Some investors focus on growth, looking for businesses that have the potential to expand significantly in the future. Others prioritize yield, opting for dividend-paying stocks that provide passive income and a reliable cash flow stream. But what if you could have the best of both worlds?

Dividend-growth investing combines growth potential with regular cash payments to investors. One stock that fits this description is Visa (NYSE: V), the global payments giant. Despite shares currently being at a 10% discount from their all-time high earlier this year, there are compelling reasons to consider buying the dip on Visa stock.

Visa’s Business Model and Growth Potential

Visa is the largest credit card, debit card, and payments network in the world, serving billions of cards globally. While Visa is the brand on many cards, it is not a bank or credit issuer. Instead, it makes money by taking a cut of every transaction processed through its network. As global consumer spending grows and transitions to digital transactions, Visa benefits from increased payment volume, positioning the company for steady growth.

Looking at Visa’s financials, revenue has consistently increased over the past decade, with trailing 12-month revenue reaching $35 billion. The company boasts an impressive operating margin of 67%, indicating a highly profitable business model. Additionally, Visa’s revenue is tied to payment volume, providing a hedge against inflation.

Why Visa’s Dividend Can Keep Growing

In the last quarter, Visa’s payment volume grew 7% year-over-year, driving a 10% increase in revenue to $8.9 billion. With expected annual payment volume growth of 5% to 10%, combined with margin expansion and new revenue streams, Visa’s earnings could grow by over 10% annually. This growth potential will generate significant cash flow that Visa can return to shareholders through dividends.

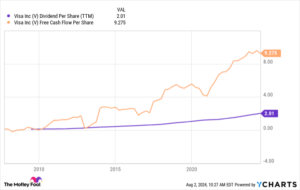

While Visa currently has a dividend yield of 0.80%, the company has a track record of dividend growth, with the dividend per share increasing by 1,800% since 2009. With room to further increase the dividend payout ratio, Visa is well-positioned to continue growing its dividend over the long term.

Our Unique Perspective at Extreme Investor Network

At Extreme Investor Network, we understand the importance of identifying opportunities that offer both growth and income potential. Visa’s strong business model, revenue growth, and dividend track record make it an attractive investment for dividend-growth investors. By buying the dip on Visa stock, investors can benefit from the company’s dominant position in the payments industry and potential for long-term dividend growth.

Don’t Miss Out on This Opportunity

If you’re looking to invest in a dividend-growth stock with significant potential, consider Visa as a part of your portfolio. With a solid business model, consistent revenue growth, and a history of dividend increases, Visa is an ideal candidate for those seeking reliable income and long-term growth. Join Extreme Investor Network today and make informed investment decisions to secure your financial future.