Extreme Investor Network Presents: Understanding the Turmoil in Japan’s Financial Markets

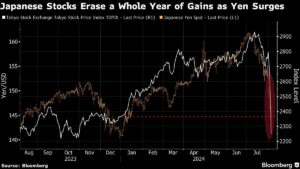

The recent turmoil in Japan’s financial markets has left investors reeling as the yen continues to strengthen against the dollar and stocks plummet into a bear market. Yields on Japanese government bonds are also sliding dramatically, causing concern among both individual and institutional investors.

The sharp appreciation of the yen, coupled with the Bank of Japan’s recent interest rate hike, has created a complex situation for Japanese policymakers. The currency’s strength is not only impacting domestic markets but also sending shockwaves through global investment strategies that rely on low borrowing costs in yen.

As Charu Chanana, head of currency strategy at Saxo Markets, points out, the situation in Japan is challenging. Loose monetary policy weakens the currency, while any hint of tightening can disrupt the stock market. The Nikkei Stock Average Volatility Index has surged to record levels, reflecting the intense selling pressure and uncertainty in the market.

All 33 industry groups represented in the Topix index have experienced declines since the Bank of Japan raised interest rates, pushing the gauge into a technical bear market. The worry is that falling stock prices could signal future business performance deterioration and potentially widen credit spreads if the economy weakens.

The benchmark 10-year Japanese government bond yield has also plummeted significantly, raising alarm bells for investors. This risk-off sentiment is not limited to Japan, as global bond rallies and fears over the US economic outlook are driving investors to seek safe havens.

The recent downturn in the Japanese stock market has led to a wave of forced selling among retail investors, who are grappling with high margin buying positions and massive losses. While there is speculation about a potential selling climax, the uncertainty surrounding the market persists.

At Extreme Investor Network, we understand the importance of staying informed and making strategic investment decisions. Our experts are dedicated to providing valuable insights and analysis to help you navigate challenging market conditions. Stay tuned for more updates and expert opinions on the latest developments in the world of finance.