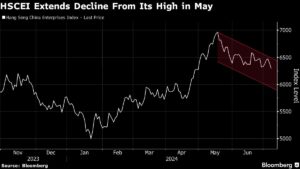

As the world closely monitors China’s economic landscape ahead of one of its biggest annual policy meetings, bearish signals are starting to surface for Chinese stocks. The recent decline in the Hang Seng China Enterprises Index, coupled with the ongoing downtrend in the CSI 300 Index, suggest that investors are becoming increasingly cautious.

The rally in Chinese equities that kicked off earlier this year has hit a roadblock, with concerns growing over the country’s uneven economic recovery and potential geopolitical risks from upcoming elections in Europe and the US. The upcoming Third Plenum, scheduled for July 15-18, is not expected to provide a quick boost for stocks, as stimulus measures have had minimal impact on key sectors like property and consumer confidence.

Xin-Yao Ng, director of investment at abrdn Asia Ltd., noted, “The Chinese domestic economy remains soft, and there’s little expectation for stimulus from the third Plenum.” Additionally, sentiments are turning negative among onshore investors, with key indexes erasing gains and trading below critical levels.

Despite the current challenges, there is hope for a rebound in Chinese stocks, thanks to attractive valuations and light positioning by global funds. If positive surprises emerge from the policy meetings and the Federal Reserve’s interest-rate decisions, Chinese equities could see a resurgence in the second half of the year. In fact, a significant number of strategists and fund managers surveyed by Bloomberg see Chinese stocks, along with Indian counterparts, as potential outperformers in Asia.

However, investors remain cautious due to currency weakness, geopolitical uncertainties, and macroeconomic challenges in China. As MSCI Inc.’s key gauge of Chinese stocks and Bloomberg Intelligence’s measure of developer shares enter technical corrections, the market remains uncertain.

At Extreme Investor Network, we are constantly monitoring these developments to provide our members with the latest insights and analysis on the ever-changing financial landscape. Join us as we navigate the complexities of the global economy and uncover investment opportunities that align with your financial goals.