Protecting Your Finances: How to Avoid Imposter Fraud

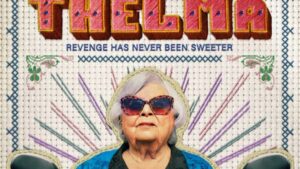

Have you ever received a call from a loved one in distress, asking for money urgently? This scenario may remind you of the movie “Thelma,” where a 93-year-old woman falls victim to a scam involving her grandson. While this story may seem like a Hollywood plot, the threat of imposter fraud is real and growing, especially in the age of artificial intelligence.

Imposter fraud, also known as grandparents’ scams or family emergency scams, accounted for nearly $2.7 billion in losses last year, according to the U.S. Federal Trade Commission. Scammers use tactics like fear and urgency to manipulate their victims into sending money.

Experts advise taking proactive measures to protect yourself and your loved ones from falling victim to these scams. One strategy is to freeze your credit, which can prevent scammers from accessing your financial information. Another option is to establish an aging plan in your late 50s or early 60s, appointing a financial surrogate to help make sound decisions later in life.

Moreover, basic security practices like setting up multifactor authentication and purchasing identity theft insurance can serve as barriers against scammers. If you do encounter a scam, report it promptly on usa.gov/where-report-scams to prevent further financial losses.

Remember, scammers target individuals of all ages, not just older adults. By staying informed and taking proactive steps to protect your finances, you can reduce the risk of falling victim to imposter fraud. Stay vigilant and prioritize your financial security to safeguard your hard-earned money.