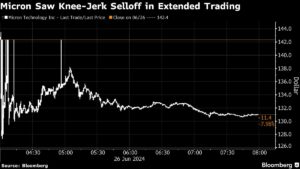

Micron Technology Inc.’s recent post-results selloff is a stark reminder of the risks involved in investing in artificial intelligence chipmakers. This is especially important for global investors who have been eyeing AI-related stocks in recent times. Just days after the leading AI chipmaker Nvidia Corp. experienced a substantial drop in its market value, Micron shares followed suit by falling about 8% in extended trading. The memory manufacturer’s forecast did not meet the highest estimates, leading to a negative reaction from the market.

The surge in AI-related stocks has been beneficial for companies like Micron, as their high-bandwidth memory is considered for use alongside Nvidia’s chips for training large language models. However, despite a strong year leading up to the recent report, Micron faced backlash for not exceeding the already elevated expectations set by investors.

The volatility in AI-related stocks has broader implications, as evidenced by the impact on South Korea’s major players like Samsung Electronics Co. and SK Hynix Inc. These memory chip providers are crucial components of the AI supply chain and are thus directly affected by the performance of companies like Micron.

The unpredictability in the market has been highlighted recently, as even companies surpassing street estimates are facing sell-offs due to unrealistic expectations. This sentiment was echoed by Andrew Jackson, head of Japan equity strategy at Ortus Advisors Pte in Singapore, who mentioned the market’s awareness of overinflated valuations in certain US companies.

The correction in Nvidia shares earlier this week, along with the overall decline in semiconductor shares, points to a slowdown in the global AI frenzy. This trend poses challenges for companies like Micron, which are still recovering from a slump in demand last year for their traditional products like memory for PCs and smartphones.

Looking ahead, the AI sector may face a reality check as investors come to terms with the inflated valuations of certain companies. Micron’s current price-to-sales ratio is significantly higher than the average over the past decade, indicating a potential bubble in the market.

As investors navigate the turbulent waters of the AI chipmaker industry, it is essential to stay informed and cautious of the risks involved in chasing the hype. The extreme volatility observed in recent weeks serves as a sobering reminder of the importance of due diligence and strategic decision-making in the realm of finance. Stay tuned to Extreme Investor Network for more valuable insights and analysis on emerging trends in the financial world.