Are you interested in the latest financial news and trends? Look no further than Extreme Investor Network for unique insights and analysis that set us apart from the competition.

In a recent move that has caught the attention of investors and analysts alike, GameStop Corp. successfully raised approximately $2.14 billion through a share sale program. This strategic initiative comes on the heels of a stock rally fueled by retail investors and amplified by Keith Gill’s positive commentary on the company’s shares upon his return to YouTube.

With this latest round of fundraising, GameStop has now amassed over $3 billion in capital over the past month through share sales, showcasing the power of retail investor influence in driving stock prices higher. The recent sale of 75 million shares at an average price of $28.49 each has bolstered the company’s financial position and sparked investor interest.

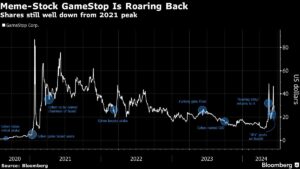

Despite a recent post-market trading increase of more than 5% to $32.27, GameStop’s stock price remains below its June peak of $48. The stock experienced a surge on Tuesday afternoon, signaling potential relief from selling pressure as it climbed 23% to close at $30.49.

Last week, GameStop made headlines by unexpectedly releasing earnings and unveiling plans to sell millions of new shares just hours before Keith Gill, also known as “Roaring Kitty,” made his highly anticipated return to YouTube. This move attracted speculators and sparked a significant stock rally that ultimately led to a sharp decline after the fundraising plan was announced.

In addition to the $933 million previously raised last month, the recent share sale further bolsters GameStop’s cash reserves, which totaled $1.08 billion at the end of the last quarter. Jefferies LLC is serving as the sales agent for the offering, with the company intending to utilize the proceeds for general corporate purposes, including potential acquisitions and investments.

Not to be outdone, fellow retail trader favorite AMC Entertainment Holdings Inc. also completed a share sale earlier this year. The financial landscape is evolving rapidly, and Extreme Investor Network is here to provide you with exclusive insights and analysis to help you navigate the ever-changing world of finance.

Stay tuned to Extreme Investor Network for the latest updates and expert analysis on the GameStop share sale program and other key developments in the financial markets. Don’t miss out on our unique perspectives that can help you make informed investment decisions and stay ahead of the curve. Subscribe now to join our community of savvy investors and take your financial knowledge to the next level.