Are you looking to understand the intricate workings of the global economy and how central banks make decisions that impact everyone? Look no further than the Extreme Investor Network, where we provide unique insights and analysis that you won’t find anywhere else.

Recently, there has been a significant shift in monetary policy as central banks around the world are starting to use the Economic Confidence Model (ECM) to make timely decisions. This model, developed over 50 years of research, has been proven to accurately predict economic trends and guide policymakers in making strategic choices.

With the recent decision by the ECB to lower interest rates, we are witnessing the influence of the ECM on shaping global economic policies. The impact of this shift is evident in the financial markets, indicating a move towards more proactive decision-making by central banks.

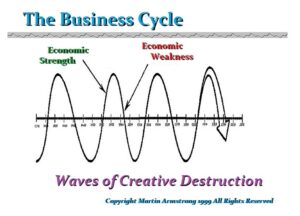

In a world where traditional economic theories like Keynesian Economics are failing, it’s crucial to understand the broader implications of the Business Cycle. This cycle incorporates various factors such as climate, social unrest, and innovation, which cannot be controlled solely through interest rate adjustments.

Historical examples, such as the influx of gold into Europe causing inflation and Spain’s economic downfall, highlight the complexity of economic systems and the limitations of traditional monetary policies. Even renowned economists like Schumpeter and Volcker have acknowledged the inherent unpredictability of the Business Cycle.

At the Extreme Investor Network, we believe it’s time for politicians and policymakers to embrace a deeper understanding of the Business Cycle and its impact on the economy. Socialism, although appealing to some, can have detrimental effects on economic growth and stability, as history has shown.

Join us at Extreme Investor Network to explore cutting-edge insights on economics, investment strategies, and the latest trends shaping the global economy. It’s time to embrace the Business Cycle and learn how to navigate its complexities for long-term prosperity.