Welcome to Extreme Investor Network! Today, we’re diving into the world of artificial intelligence (AI) stocks, a rapidly growing sector where investors are looking to capitalize on the incredible potential of cutting-edge computer chips. In this blog post, we’ll highlight three AI stocks that investors should consider adding to their portfolios for long-term growth.

- Nvidia: The Undisputed Leader

When it comes to AI chip technology, Nvidia (NASDAQ: NVDA) stands out as the undisputed leader. With its powerful graphics processing units (GPUs) and AI-focused software stack, Nvidia has become the go-to option for tech giants investing heavily in data centers to support AI operations. In fact, some analysts estimate that Nvidia controls up to 90% of the AI chip market.

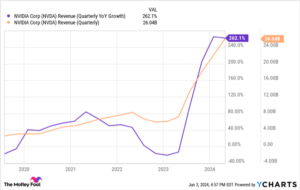

Nvidia’s impressive revenue growth tells the story of its success in the AI space. The company generated $22.6 billion in data center revenue in Q1, almost matching its total revenue for the entire fiscal year of 2023. As a result, Nvidia’s stock price has skyrocketed by 585% over the past three years.

Looking ahead, CEO Jensen Huang predicts that AI will drive another $2 trillion in data center spending, providing Nvidia with significant tailwinds for years to come. With a forward P/E of 42 and analysts projecting 38% annual earnings growth over the next three to five years, Nvidia remains a compelling investment opportunity.

- AMD: A Strong Challenger

While Nvidia dominates the AI chip market, Advanced Micro Devices (AMD) (NASDAQ: AMD) is emerging as a strong challenger. AMD’s data center sales grew by 80% year over year in Q1, driven by demand for its MI300 accelerator chips that compete with Nvidia’s offerings.

Aside from its presence in data centers, AMD has a foothold in AI-enabled personal computers, which presents a significant growth opportunity. The company’s Ryzen 8000 Series processor chips contributed to an 85% year-over-year increase in AMD’s Client segment in Q1. With analysts forecasting 42% annual earnings growth over the next three to five years, AMD has the potential to outperform its competitors in the AI space.

Despite being a fraction of Nvidia’s size with a market cap of $263 billion, AMD’s forward P/E of 49 offers investors an attractive valuation if the company can meet analysts’ expectations. As AMD continues to innovate and expand its AI offerings, it could pose a real threat to Nvidia’s dominance in the future.

In conclusion, both Nvidia and AMD are compelling AI stocks to consider adding to your portfolio. With AI technology becoming increasingly essential across industries, investing in these companies could provide substantial returns in the long run.

At Extreme Investor Network, we provide expert insights and analysis on AI stocks and other investment opportunities. Stay tuned for more valuable information to help you navigate the world of finance and investing.