Welcome to Extreme Investor Network, where we provide you with unique and valuable insights to help you make informed decisions about your investments. We understand that timing is crucial in the world of finance, and that’s why we’re here to guide you on when to jump into stocks that are on the rise.

When it comes to investing, it’s often said that buying stocks on a dip is the best strategy. After all, why pay more when you can pay less? However, there are times when it’s worth considering jumping into a stock that is already soaring. In this article, we’ll take a closer look at three such stocks that are worth considering despite their current strength.

**MercadoLibre (NASDAQ: MELI)**

If you haven’t heard of MercadoLibre, also known as the Amazon of Latin America, you’re not alone. This e-commerce giant operates in Latin America and offers online malls, payment services, and logistics to support its operations. With the rapid growth of internet and mobile phone penetration in South America, MercadoLibre is well-positioned for significant growth in the region’s e-commerce market. Analysts expect the company to see substantial revenue growth in the coming years, making it a stock to watch.

**DraftKings (NASDAQ: DKNG)**

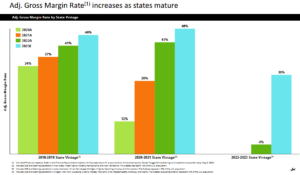

DraftKings, a sports-betting stock, has seen its shares soar more than 300% since the end of 2022. Despite this impressive rally, there is still upside potential for the company as more states legalize sports betting and existing customers become more profitable over time. With strong growth prospects and a path to profitability, DraftKings is a stock worth considering for long-term investors.

**Walmart (NYSE: WMT)**

Walmart, the world’s largest retailer, has been firing on all cylinders with impressive revenue and earnings growth. The company’s ability to maintain a wide assortment of merchandise at competitive prices has attracted a large customer base, including high-income households. As the economy continues to recover, Walmart is well-positioned to capitalize on shifting consumer preferences and maintain its growth trajectory.

In conclusion, while it’s important to be cautious when investing in soaring stocks, there are times when jumping in early can lead to significant gains. By understanding the underlying fundamentals and growth potential of these companies, investors can make informed decisions that align with their long-term financial goals.

For more investing insights and recommendations, be sure to check out Extreme Investor Network for expert analysis and recommendations on the best investment opportunities in the market. Stay ahead of the curve and take your portfolio to the next level with our unique insights and strategies.