When it comes to investing, dividends can play a crucial role in building a reliable passive income stream. Companies around the world paid a record $606.1 billion in dividends to their shareholders during the second quarter — 8.2% more than the prior-year period. This data suggests that right now is a great time for dividends. However, the ability of companies to maintain these payments can vary, especially during downturns and recessions.

For investors seeking reliable dividend payments, there are certain stocks that stand out. Enterprise Products Partners (NYSE: EPD), Enbridge (NYSE: ENB), and American States Water (NYSE: AWR) are models of dividend durability. These companies have a history of consistently paying dividends to investors regardless of market conditions, making them attractive options for income-focused investors.

Why Enterprise Products Partners Should Be on Your Radar

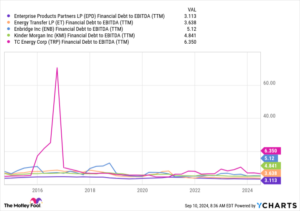

Enterprise Products Partners boasts a 7.2% distribution yield, which is significantly higher than the S&P 500’s current yield of just 1.2%. This makes the stock an attractive option for investors looking to generate passive income. Beyond its high yield, Enterprise Products Partners is one of the largest midstream energy businesses in North America with a diverse portfolio of energy infrastructure assets. This asset base generates reliable fee income over time, supporting the company’s dividend payments.

What sets Enterprise Products Partners apart is its strong financial position. The company’s distributable cash flow covers its distribution by a safe 1.7 times, ensuring that the dividend is sustainable. With an investment-grade rated balance sheet and a track record of 26 consecutive years of dividend increases, Enterprise Products Partners is a solid choice for investors seeking a reliable high-yield income stock.

The Resilience of Enbridge’s Dividend

Enbridge is another company known for its consistent dividend payments. The Canadian pipeline and utility company has a track record of increasing its dividend for 29 straight years, making it one of the most reliable dividend stocks in the energy sector. Enbridge’s earnings are highly durable and predictable, with 98% of its income coming from cost-of-service or contracted assets.

Enbridge’s financial profile is strong, with a leverage ratio on track to reach the low end of its target range by next year. The company’s growth prospects are also promising, with an extensive backlog of capital projects that support management’s goal of growing earnings at an annual rate of around 5% over the medium term. With a dividend yield of more than 6.5%, Enbridge offers investors an attractive income-generating opportunity.

American States Water: The Dividend King

American States Water has a remarkable track record of dividend growth, having increased its dividend every year for the past 70 consecutive years. This makes the stock the Dividend King with the longest active streak of dividend increases in the U.S. market. The company’s regulated water utility business generates stable and predictable cash flows, supporting its consistent dividend payments.

American States Water has been able to achieve a compound annual dividend growth rate of 8.8% over the past five years, with the latest hike being an 8.3% boost. With a target of at least 7% payout growth in the long term, American States Water offers investors a reliable income stream with the potential for ongoing dividend increases.

Investing in Reliable Dividend Stocks

When it comes to investing in dividend-paying stocks, companies like Enterprise Products Partners, Enbridge, and American States Water stand out for their dedication to rewarding shareholders with consistent and growing dividends. These companies have a proven track record of weathering market fluctuations and economic downturns, making them attractive options for income-focused investors.

For investors looking for reliable dividend payments, these three stocks offer a compelling combination of high yields, financial stability, and dividend growth potential. By incorporating dividend stocks like these into your investment portfolio, you can build a reliable income stream for the long term.