When it comes to investing in the stock market, timing is everything. Most investors aim to buy stocks when they are on a dip, allowing them to get more value for their money. However, there are times when it makes sense to invest in a stock that is already soaring. Although a pullback may be on the horizon, the risk of waiting and missing out on potential gains can be greater. The key is knowing when to seize these opportunities.

At Extreme Investor Network, we follow the market closely to identify stocks that may be at rally-driven highs but still hold great long-term investment potential. Here, we take a closer look at three stocks that are worth considering, even as they reach new highs.

-

Home Depot (NYSE: HD)

Despite a gloomy real estate market outlook, home improvement retailer Home Depot has seen its stock reach new 52-week highs. The housing shortage in the United States, combined with pent-up demand for home improvement projects, positions Home Depot to capitalize on future growth opportunities. As the biggest name in the business, the retailer is well-positioned to dominate the growing home improvement market. With interest rates stabilizing and supply and demand balancing out, Home Depot’s future looks promising. -

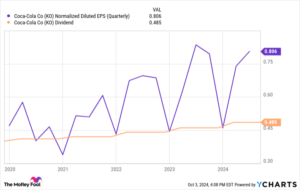

Coca-Cola (NYSE: KO)

Coca-Cola may seem like a safe and reliable stock pick, which is why its shares are still near record highs. While the beverage giant may not have explosive growth potential, its consistent performance and dividend track record make it a solid long-term investment. With a diverse portfolio of beverages and a strong global presence, Coca-Cola is well-equipped to weather market uncertainties and deliver steady returns over time. - Microsoft (NASDAQ: MSFT)

Software powerhouse Microsoft is another stock that continues to soar, thanks to its dominant position in the software and cloud computing markets. With a track record of innovation and adaptability, Microsoft has consistently grown its top and bottom lines. Despite its recent impressive gains, Microsoft remains a compelling 20-year investment due to its ability to capitalize on new opportunities as they arise. From cloud computing to artificial intelligence, Microsoft’s diverse portfolio positions it for long-term success.

At Extreme Investor Network, we prioritize identifying stocks with long-term growth potential and providing our readers with valuable insights to make informed investment decisions. Stay tuned for more expert analysis and recommendations to help you navigate the ever-changing world of finance.

Invest wisely with Extreme Investor Network – where extreme investments meet extreme returns.