Analyzing the Hidden Gems: Three Stocks That Are Cheap for a Reason… and That’s a Good Thing

In the vast landscape of the stock market, discerning which companies represent genuine value is a daunting task. It’s not merely about the price you see per share; it’s about understanding a company’s underlying valuation. This distinction is crucial because "cheap" stocks can sometimes boast share prices in the hundreds, while "expensive" stocks can appear more accessible.

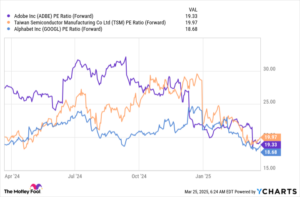

Today, let’s shine a spotlight on three companies that, despite current price evaluations, show incredible potential for growth: Taiwan Semiconductor Manufacturing (TSMC), Alphabet (GOOG/GOOGL), and Adobe (ADBE). Recently, these stocks have faced sell-offs, presenting savvy investors with a remarkable opportunity to seize shares before the market corrects itself.

Understanding Valuation: The Forward P/E Ratio

To evaluate these companies, we will look closely at their forward price-to-earnings (P/E) ratios. This metric holds more weight than trailing P/E ratios because it reflects future growth expectations rather than historical performance. After all, the market is inherently forward-looking, and while analyst projections can be prone to inaccuracies, they serve as a valuable guide for anticipating future performance.

At present, the S&P 500 trades at around 21 times forward earnings. However, TSMC, Alphabet, and Adobe are all positioned below this average, each trading for less than 20 times their projected earnings. Keep an eye on these indicators; stocks priced below their potential can signal excellent buying opportunities.

TSMC: The Power Player in Semiconductors

Taiwan Semiconductor Manufacturing Company (TSMC) stands as a titan in the semiconductor industry, and it’s positioned for monumental growth. TSMC remains the leading semiconductor foundry, making chips for other companies that lack manufacturing facilities. This unique position gives TSMC invaluable insights into the chip industry.

Management projects nearly a 20% compound annual growth rate (CAGR) in revenue over the next five years—significantly outpacing the market’s typical 10% growth rate. This growth potential hasn’t yet reflected in TSMC’s stock price, making it a compelling investment opportunity for those who understand the dynamics at play in the tech sector.

Alphabet: Strong Fundamentals with Growth Ahead

Moving on to Alphabet, the parent company of Google, this tech giant has consistently demonstrated solid performance in its advertising business. Analysts foresee growth rates of 11% for the upcoming two years. Investment strategies focusing on efficiency combined with aggressive share repurchases will likely enhance earnings per share (EPS), with expectations of 12% and 14% EPS growth in 2025 and 2026, respectively. This makes Alphabet a prime candidate for value-minded investors seeking stability with growth prospects.

Adobe: The Underdog Poised for a Comeback

Last but certainly not least is Adobe, which has caused a stir among investors concerned about AI disruption. While some fear that the rise of AI could undermine its business, Adobe is innovating through its Firefly AI service, still showing solid 10% revenue growth year-over-year. Despite trading at a discount—especially considering its aggressive buyback program, which aims to repurchase around 6% of its total shares this year—Adobe has considerable upside potential.

With these dynamics, investors can expect Adobe’s earnings growth to accelerate significantly. A mixture of stable revenue growth and strategic buybacks sets Adobe up as a company poised to outpace market expectations in the years to come.

Conclusion: Seize the Opportunity

While none of these companies may be the flashiest growth stocks in the immediate future, they offer unique value propositions that can lead to outperforming the market. In a climate where good deals are fleeting, now is the opportune moment to consider these stocks for your portfolio.

Have you ever felt as if you missed out on investing in the biggest winners? Well, at Extreme Investor Network, our seasoned analysts frequently issue “Double Down” stock recommendations for firms they believe are primed for an imminent breakthrough. If you’re inclined to explore these exciting prospects before they soar, you might just find your next big investment within our carefully curated insights.

Stay ahead of the curve with us, and you may capture the value that others overlook.