Exploring Dividend Stocks: A Deep Dive into Visa and Novartis

For income investors, the desire is clear: steady and growing dividends for the long haul. Yet, the unfortunate reality is that some companies can and do suspend their dividend distributions, often due to unforeseen business challenges. This is a risk every investor must acknowledge. However, there are shining examples of companies that not only weather economic storms but thrive — Visa (NYSE: V) and Novartis (NYSE: NVS) being two prime candidates in this arena.

Why Visa Is a Dividend Champion

Visa has firmly established itself as a leader in the payment network sector, boasting a remarkable dividend-paying history since its public debut in 2008. Investors in Visa are rewarded with consistent annual increases in dividend payouts, showcasing a commitment to shareholder value.

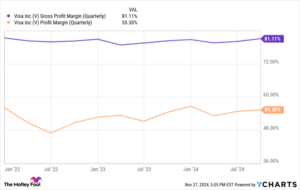

What sets Visa apart is its impressive financial performance. The company generates robust and growing revenue streams, backed by significant earnings and impressive free cash flow. With hundreds of millions of credit card transactions processed daily, Visa captures a small percentage of each transaction, contributing to its generous profit margins. Typically, Visa achieves around 80% gross margins, translating to about $0.50 in net income for every dollar of revenue — a rarity for a corporation of its size.

The Network Effect

Visa’s business model benefits greatly from the network effect. As more banks, consumers, and businesses engage with its payment ecosystem, its value increases exponentially. This unique positioning not only creates high barriers for competitors but also mitigates the risks associated with the increased digitization of payment methods. Visa is pivoting amid this evolution, ensuring it continues to thrive and grow in an ever-changing financial landscape.

With trillions of dollars’ worth of transactions still conducted outside the realms of digital payments, Visa is poised for tremendous growth. The ongoing displacement of cash in favor of digital transactions heralds a bright future for the company — thus ensuring investors can expect sustained returns and consistent dividend growth.

Novartis: The Steady Pharma Giant

Transitioning to the pharmaceutical realm, Novartis stands tall as a powerhouse in drug development and distribution. With a long-standing history in the industry, Novartis embodies stability amidst change, continually evolving its product offerings to stay at the forefront of the pharmaceutical market.

In recent reports, Novartis displayed robust financial results, showcasing a year-over-year revenue increase of 9% to $12.8 billion and an impressive 18% rise in earnings per share to $2.06. Additionally, the company recorded an 18% increase in free cash flow, totaling around $6 billion. This performance is particularly impressive considering the company’s recent strategic shift, including the spin-off of its generic and biosimilar unit, Sandoz.

While this maneuver has led to a leaner operational footprint, it positions Novartis to concentrate on higher-growth opportunities without the complications of a disparate pipeline diluting resources. Even with a narrowed focus, Novartis maintains a diverse portfolio of dozens of development programs poised for regulatory approval, ensuring continued revenue growth.

A Commitment to Shareholders

Novartis has an enviable record of dividend increases, boasting an impressive 27 consecutive years of payout hikes. Currently offering a competitive dividend yield of 3.65%, significantly exceeding the S&P 500 average of 1.32%, Novartis proves its unwavering commitment to rewarding shareholders.

The Bottom Line: Buy and Hold for a Bright Future

Both Visa and Novartis present compelling cases for dividend investors looking for stocks to buy and hold indefinitely. Their consistent financial performance, robust growth prospects, and commitment to shareholder value underscore their positions as reliable dividend-paying companies in today’s market.

Don’t Miss the Next Big Opportunity!

If you’ve ever felt like you missed your chance at early investments in successful companies, fear not. Our expert team at Extreme Investor Network is on a constant lookout for high-potential "Double Down" stock opportunities. Make sure you’re in the loop and positioned for potential outsized gains. The stories of monumental successes like Nvidia and Apple highlight just how impactful timely investments can be.

Discover the 3 “Double Down” stocks you shouldn’t miss this season and secure your future today!