The Roller Coaster of Tech Stocks: Finding Opportunity Amidst Volatility

The tech sector has been like a roller coaster in 2025, with market fluctuations driven by tariffs, interest-rate concerns, and a shifting political landscape. While some investors are opting to pull out, astute investors know this turmoil can present unique investment opportunities.

Below, we delve into a couple of tech stocks currently trading at significant discounts. This may be the perfect moment to reassess these choices while Wall Street takes a breather.

Why Invest $1,000 Now?

Our team of financial analysts has identified 10 top stocks poised for growth right now. Among them are two standout candidates that warrant your attention.

AppLovin (NASDAQ: APP)

AppLovin specializes in empowering mobile app developers with effective marketing and monetization tools. Recently priced around $270 per share, this stock has witnessed a meteoric rise of over 300% since its IPO in 2021.

However, 2025 has not been as forgiving, with a 23% dip attributed partly to a controversial short report from Muddy Waters Research. This report raised concerns regarding potential violations of platform terms of service and suggested a troubling client churn rate of 23% in Q1 2025.

In response, AppLovin’s CEO, Adam Foroughi, firmly rejected these claims, insisting that the company operates with integrity and full compliance.

Strong Financials

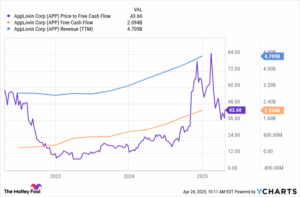

Despite the turmoil, AppLovin boasted impressive financial results in 2024, with revenues climbing to $4.7 billion and free cash flow hitting $2.1 billion—a staggering 100% year-over-year increase. The firm has efficiently deployed capital by repurchasing stock, reducing its outstanding shares by 10% over the past three years.

At a glance, AppLovin’s valuation might appear high at 43.6 times free cash flow, but in tech, aggressive multiples often reflect future growth potential. Given that its free cash flow doubled in 2024, this stock might be undervalued—currently trading about 50% below its peak price-to-free cash flow multiple.

Nvidia (NASDAQ: NVDA)

Another name making waves in the tech scene is Nvidia, a leader in supplying the ecosystem necessary for AI developments. Once soaring to become the world’s most valuable publicly traded company, its shares have recently settled at $104, down from a peak of $153—a drop of over 30%.

Nevertheless, the company continues to thrive, generating an impressive $130.5 billion in revenue for fiscal 2025, alongside $72.9 billion in net income—a remarkable increase of more than 100% on both fronts compared to fiscal 2024.

Navigating Economic Uncertainty

Despite Nvidia’s success, the company faces challenges, particularly related to uncertainty around tariffs that could impact its high gross margin, projected to dip to between 70.6% and 71% in fiscal Q1 2026. Key management has acknowledged these challenges but remains optimistic about Nvidia’s pivotal role in the mainstream adoption of AI.

Nvidia currently trades at a 35.6 times trailing earnings. While this might scare value investors, the forward P/E ratio, reflecting expectations for the coming year, adjusts to a more appealing 23.6 times earnings.

Long-Term Outlook

Though growth stocks often take the hit during turbulent markets, the present pullback offers savvy investors a chance to acquire shares at favorable rates. With the growth trajectory of mobile advertising for AppLovin and the AI surge driving Nvidia’s future, this market moment could be a golden opportunity—if you’re willing to look beyond short-term noise.

Missing the Boat?

If you’ve ever felt you missed out on top-performing stocks, now might be the time to act. Our expert analysts have identified several “Double Down” stock recommendations—companies primed for substantial growth.

Just consider the wealth generated for our past recommendations:

- Nvidia: A $1,000 investment circa 2009 would be worth $276,000!

- Apple: $1,000 in 2008 would now yield $39,505!

- Netflix: $1,000 from 2004 has skyrocketed to $591,533!

Currently, our “Double Down” alerts feature three outstanding firms, available to members who join Stock Advisor. This could be your opportunity to turn market turmoil into profit.

Conclusion

Even amidst uncertainty, companies like AppLovin and Nvidia present prime opportunities for long-term growth. If you focus on their potential rather than short-term volatility, you may find your next big investment.

Dive in, explore our analyses, and take your investor journey to the next level with Extreme Investor Network!