Nvidia’s Unstoppable Growth Trajectory Amidst AI Revolution

When it comes to explosive growth, Nvidia (NASDAQ: NVDA) has been leading the pack, soaring over 750% since early last year. The driving force behind this meteoric rise lies in the transformative power of generative artificial intelligence (AI). Leveraging AI to streamline workflows and automate processes has the potential to revolutionize industries, boost productivity, and drive profits for forward-thinking businesses.

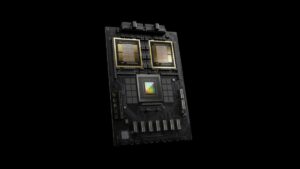

Nvidia’s GPUs are at the forefront of this AI evolution, providing the computational muscle required for cutting-edge AI processing. This has created a massive surge in demand for the company’s high-performance processors, propelling its business and financials to new heights and culminating in a recent 10-for-1 stock split.

While some may question whether Nvidia has already reached its peak, others see a bright future ahead. One analyst believes that Nvidia possesses a key advantage that will keep it ahead of the competition and unleash a “cash gusher” that will benefit shareholders.

The foundation for Nvidia’s success can be traced back to its long-standing dominance in key markets. The company has long been the go-to choice for serious gamers, controlling a significant share of the desktop GPU market. Additionally, Nvidia’s GPUs have found widespread adoption in data centers and machine learning applications, solidifying its position as the industry leader.

With the upcoming release of its Blackwell family of processors, Nvidia is poised to reach new heights. CEO Jensen Huang’s confidence in the Blackwell Architecture platform suggests that this product line could be a game-changer for the company and its investors.

Despite the looming threat of competition, Nvidia has managed to maintain its edge in the market. The company’s strategic approach to hardware and software integration gives it a unique advantage that is hard for rivals to replicate. This full-stack approach, along with Nvidia’s relentless pace of innovation, sets it apart from the pack and cements its position as a frontrunner in the industry.

Looking ahead, Nvidia is expected to generate a staggering $270 billion in cash over the next three years, signaling a wave of potential returns for shareholders. With a strong focus on R&D and innovation, Nvidia is well-positioned to sustain its growth trajectory and reward investors handsomely.

As evidence of its commitment to shareholders, Nvidia recently announced a $25 billion share repurchase plan and increased its dividend payment by 150%. Despite these moves, the company still has ample room to return cash to investors, with the ongoing wave of AI adoption fueling its financial firepower.

In conclusion, Nvidia’s unparalleled success in the AI realm, coupled with its strategic advantages and robust growth prospects, make it a compelling investment opportunity for those looking to capitalize on the AI revolution. With Nvidia leading the charge, shareholders stand to benefit from a “cash gusher” that could drive substantial returns in the wake of its 10-for-1 stock split.

If you’re considering investing in Nvidia, now could be the perfect time to seize this opportunity and ride the wave of AI innovation with a company at the forefront of the industry.

At Extreme Investor Network, we pride ourselves on delivering valuable insights and analysis to help our members make informed investment decisions. Stay tuned for more exclusive content and expert guidance on navigating the dynamic world of finance and investing.