Market Insights: Key Events and Stock Picks for the Week Ahead

As we gear up for a week filled with significant market movements, several key events are set to shape investor sentiment. Here’s what to watch:

Focus on the Fed Meeting and Interest Rates

This week sees the much-anticipated Federal Reserve meeting. Market participants will be closely watching the outcome, especially the Federal Open Market Committee (FOMC) dot-plot and Fed Chair Jerome Powell’s news conference. While the Fed is expected to maintain the current interest rates at this meeting, Powell might hint at potential cuts by mid-year, offering insights that could influence market stability.

Additionally, the dot-plot will provide new projections for interest rates alongside forecasts for unemployment and inflation. Current expectations, as per the Investing.com Fed Rate Monitor Tool, suggest that the Fed will hold off on rate cuts until June.

Nvidia’s GTC Conference: A Potential Buying Opportunity

Investors should keep an eye on Nvidia (NASDAQ: NVDA) this week as the company hosts its GPU Technology Conference (GTC) starting Monday in San Jose, California. This four-day event, often dubbed as the "world’s premier AI conference," will showcase Nvidia’s latest innovations in generative AI and accelerated computing.

Expect a highly impactful keynote from CEO Jensen Huang, where he will outline how Nvidia’s advancements in AI and cloud technologies will drive future growth. Historically, Nvidia has seen its stock outperform the Philadelphia Semiconductor Index around GTC events. With analysts projecting a significant upside potential of around 41.8%, Nvidia could be a strong buy as it looks to unveil game-changing technologies, including its next-gen GB300 AI chip.

Nike’s Earnings Report: A Stock to Watch

Conversely, Nike (NYSE: NKE) is preparing to release its fiscal third-quarter earnings report this Thursday, and market sentiment appears bleak. With recent leadership changes and ongoing challenges in navigating the competitive landscape, Nike may not meet investor expectations. Analysts predict a significant year-over-year decline in adjusted earnings per share, making NKE a candidate for selling.

Options market volatility indicates a potential 9% swing in either direction post-report, but the overwhelming consensus among analysts has been negative, with no upgrades leading into the announcement. Given the company’s recent struggles with sales and inventory management, a cautious approach may be prudent.

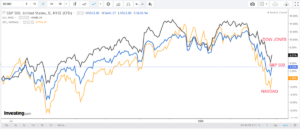

U.S. Stocks Rebound Amidst Trade War Fears

It’s essential to consider the broader market context. Following a challenging week, U.S. stocks experienced a bounce on Friday, thanks in part to easing tensions from President Trump’s trade narratives. However, the S&P 500 and Nasdaq Composite have posted four consecutive weeks of losses, underscoring the ongoing volatility and uncertainty fueled by recession fears. The Dow saw its steepest losses in years, dropping 3.1% last week.

As we witness these fluctuations, Monday’s U.S. retail sales report may offer additional insights into the economic landscape. The upcoming corporate earnings from platforms like FedEx, Micron, and others will further inform investor outlooks as the earnings season wraps up.

Stay Ahead with Actionable Trade Ideas

Navigating this volatile market requires discernment and strategy. At Extreme Investor Network, we offer a comprehensive suite of tools, including AI-selected stock winners from InvestingPro, a sophisticated stock screener, and exclusive insights from top investors. Our goal is to empower you to make informed decisions amid market fluctuations.

Whether you are a seasoned investor or starting out, now is the time to leverage our resources and stay positioned for opportunities in the week ahead.

Conclusion

As we head into an eventful week marked by crucial economic updates and corporate earnings, keeping a pulse on Nvidia and Nike will be vital. By utilizing the insights and tools offered by Extreme Investor Network, you can stay ahead of the curve, ensuring your investment strategies align with the evolving market conditions.

For exclusive access to actionable trading insights, consider subscribing to our network today!