Why Lucid Group Could Be Your Next Big Investment Opportunity in the EV Sector

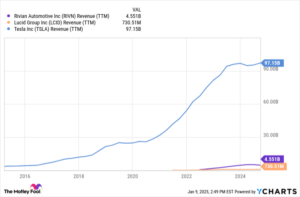

Tesla has undeniably set the gold standard in the electric vehicle (EV) industry, boasting a market cap that flirts with $1 trillion. But the real question on every investor’s mind is: who’s the next Tesla? If you have as little as $200 to invest, all eyes should be on Lucid Group (NASDAQ: LCID).

Currently valued under $10 billion, Lucid Group has immense growth potential. When considering Tesla’s trajectory, it isn’t hard to envision Lucid one day attaining a valuation exceeding $100 billion. But before diving into this high-stakes arena, it’s crucial to grasp the current landscape and Lucid’s position within it.

The Current Market Dynamics

While Lucid has seen impressive sales growth since its inception, a significant portion of its journey still lies ahead. Despite recent gains, EV sales in the U.S. still account for only 7% of the overall car market. This marks a notable increase from just 1% in 2018, but it still highlights the vast room for growth.

Analysts predict a promising trajectory for EV sales over the coming years. According to S&P Global, while 2024 may pose some challenges, subsequent years are expected to witness a substantial uptick in both production and demand. Their report anticipates that EVs will account for 25% of all car sales in the U.S. by 2030. If this forecast proves accurate, we’re looking at tripling EV sales in just five years.

Lucid’s Strategic Position

Lucid is undoubtedly positioned well within this burgeoning market. Past difficulties faced by other EV manufacturers often stemmed from operating in a relatively underdeveloped market, where demand was minimal. Now, the EV sector is gaining momentum, with more consumers recognizing the value and practicality of these vehicles.

In its recent reports, Lucid has demonstrated significant sales growth, achieving an impressive 70% year-over-year increase in just the last quarter. Analysts project that Lucid will generate $1.69 billion in sales this fiscal year—a compelling figure, especially considering their trend of continually increasing sales figures.

A Closer Look at Product Offerings

A key driver behind Lucid’s robust growth is its product lineup. The company has introduced the Air sedan and the Gravity SUV, which recently started production. These luxury models are priced between $70,000 and $100,000, which, while aimed at a high-end market, showcases Lucid’s ability to produce appealing products with strong buyer interest even before it can break into the mass market.

Monitoring Profitability Metrics

Amid this rapid growth, investors should keep a close eye on Lucid’s profitability metrics. The company currently has a premium valuation—trading at about 10 times sales compared to Tesla, which is around 14 times sales and Rivian at 3.3 times. The market typically assigns smaller companies a level of trust at this stage, but understanding Lucid’s margin performance will be crucial moving forward, especially as competition intensifies.

As we await Lucid’s next quarterly earnings report on February 25, one number that stands out on our radar is gross margin. Watching whether their margins improve or languish will provide critical insight into the company’s capacity to scale sustainably.

Future Growth and Investment Strategy

With Lucid’s two luxurious models already in production and strong sales expectations for the coming years, the future looks bright. The EV market’s long-term trajectory promises to remain upward, potentially providing investors with substantial gains.

If you’ve ever felt like you missed the boat on Tesla and other high-performing stocks, now may be your chance to capitalize on emerging opportunities. At Extreme Investor Network, our team of analysts regularly identifies lucrative “Double Down” stock recommendations—companies poised for significant upward momentum.

For instance, if you had invested $1,000 in Nvidia when we highlighted the opportunity back in 2009, you’d be sitting on an astonishing $352,417 today. Similar potential awaits with our latest “Double Down” alerts.

Conclusion

Ultimately, Lucid Group – a name buzzing with potential – could be the next big player in the electric vehicle industry. Investing early on this journey might come with risks, but for those willing to weigh their options and act strategically, the rewards could prove immensely fruitful.

Stay tuned as we keep you updated on high-stake investment opportunities and the evolving landscape of the EV market. Your next big investment could be just around the corner with Extreme Investor Network.